It’s time to set out on an exciting journey as we explore the extraordinary life of Warren Buffett. It’s a story of never giving up, making smart choices, and leaving a profound impact on millions of self-directed investors that forever changed the definition of investing.

In this Article

ToggleThe Context

Introducing our exciting new series that showcases amazing people in finance and investing!

In this episode, we’re diving into the captivating story of Warren Buffett, the legendary investor who has made a huge mark on the financial world.

As of August 2023, Forbes says he’s worth about $117.4 billion, ranking him as the 6th richest person globally, just behind Bill Gates. Whether you’re new to finance or know a lot about it, get ready for an inspiring adventure filled with interesting stories and useful tips.

Understanding the Intellect of Warren Buffett

Once upon a time, amid the Great Depression, a baby boy named Warren Buffett was born on August 30, 1930, in Omaha, Nebraska. He was the only son among three brothers, and his family struggled with financial hardships caused by the 1929 Financial Crash.

Despite the tough circumstances, young Warren dreamt of becoming wealthy. He had a keen entrepreneurial spirit from a very early age. He sold gum, soda, and lemonade, cleverly setting up his lemonade stand on a busy street to attract more customers.

When his father’s career as a congressman required them to move to Washington, Warren didn’t like the idea at all. To make money and go back to his hometown of Omaha, he took up delivering newspapers. At just 13 years old, he even filed his first tax return, showing an early interest in handling finances. At 14, he invested $1,200 in acres of farmland back in Nebraska, where he later went to live with his grandfather and finish school.

Before starting college, Warren ventured into a pinball machine business, placing the first one in a local barbershop. Soon, he expanded and had several machines, earning around $50 a week. The money he made from his ventures made him wonder if he should skip college and work on his businesses full-time.

Influenced by his father, he decided to attend The Wharton School, but it didn’t fulfill his expectations, and he didn’t stay long. However, his journey led him to meet Benjamin Graham, a renowned investor, and writer of “The Intelligent Investor,” who became Warren’s mentor and hero.

Despite being rejected by Harvard Business School, Warren found his way to Columbia University, where Graham taught. There, he built a strong bond with his mentor and gained valuable insights into value investing.

In 1956, Warren took a significant step and started his own company with $105,100 from seven partners, including family and friends. As time went on, he made several important investments and grew his business.

In 1961, he faced challenges with a company called Dempster Mill Farm Products, but he knew how to find solutions. He sought help from Charlie Munger, whom he met in 1959. With Munger’s assistance, Warren managed to sell the company for $2.3 million in 1963.

Buffett’s company continued to thrive and grew to manage $7.2 million by 1962. He attracted 90 partners from all over the country, making his mark in the investment world.

In 1967, Warren made a significant purchase when he acquired a textile company called Berkshire Hathaway. Although it turned out to be one of his worst investments, he didn’t give up. Instead, he used Berkshire Hathaway as his investment vehicle and closed his previous firm in 1970.

Throughout the 1970s, Warren Buffett and Charlie Munger refined their investment approach. They started acquiring well-known companies facing temporary problems but with strong fundamentals, setting the stage for even greater success in the future. And so, the legend of Warren Buffett, the brilliant investor, continued to grow, leaving an incredible impact on the world of finance.

Solving Buffett’s Puzzle

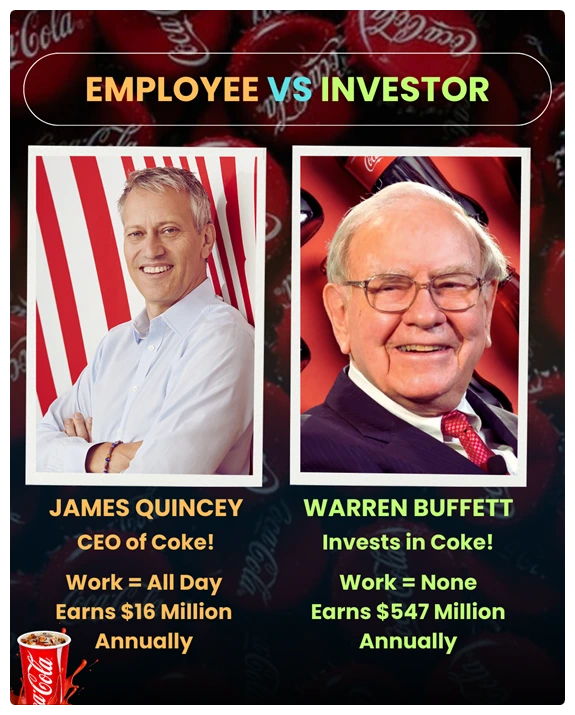

Influenced by his friend and business partner, Charlie Munger, Warren Buffett tweaked his investment strategy while staying true to his value investing approach. He developed a philosophy of seeking “great companies at a fair price” instead of only looking for “great companies at a great price.”

This means that Warren preferred to invest in strong companies with a good reputation and track record, even if they were facing temporary problems that caused their stock prices to drop. He believed that such companies would eventually bounce back and provide excellent returns in the long run.

In essence, Warren continued to follow the value investing teachings he learned from his mentor, Benjamin Graham but adjusted the strategy based on the insights he and Munger gained throughout their journey in the investment world.

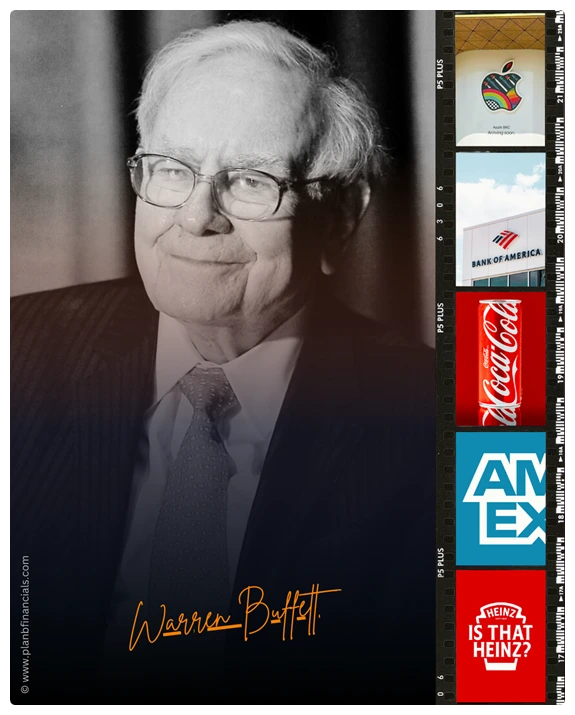

Let’s Talk Stocks: The Fab Five

Warren Buffett’s investment portfolio consists of impressive holdings, including some well-known companies. As of the latest available data, some of his top stock holdings are:

1. Apple Inc. (AAPL)

A technology giant known for its innovative products and services.

2. Bank of America Corporation (BAC)

One of the largest banks in the United States, providing various financial services.

3. The Coca-Cola Company (KO)

A global beverage company is famous for its iconic soft drink brand.

4. American Express Company (AXP)

A leading financial services company offering credit cards and more.

5. The Kraft Heinz Company (KHC)

A major player in the food industry, producing popular brands like Kraft and Heinz.

Kindly take note that these investments may undergo alterations over time. It’s also important for informed investors to understand that attempting to mimic the holdings of prominent market players might not be wise.

Even though a 1% investable portfolio exposure in a company could amount to $50 million for the biggies, the same percentage for an ordinary investor might only equate to $50. As a result, the possible returns for the latter could end up being notably diminished and not worth the effort to replicate all the time.

Pearls of Buffett’s Wisdom

Here are some top quotes shared by Warren Buffett during his investing career that shed light on the core of his investment philosophy.

💬 “The stock market is designed to transfer money from the Active to the Patient.”

💬 “Risk comes from not knowing what you’re doing.”

💬 “The best investment you can make is in yourself.”

💬 “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Buffett’s Influence Continues

Warren Buffett is a legendary investor known for having the highest share price in the stock market. Despite his immense wealth, he lives a simple life, staying physically and mentally healthy while keeping his emotions in check and showing great humility.

His life serves as proof of the effectiveness of value investing and the power of resilience in difficult times. As we come to the end of this chapter in our series, we hope you find inspiration from his story and gain valuable insights for your own financial journey.

Stay tuned for more captivating stories of influential figures in finance as we reveal their secrets to success. Remember, with dedication and a love for learning, you too can create a remarkable path to financial prosperity.