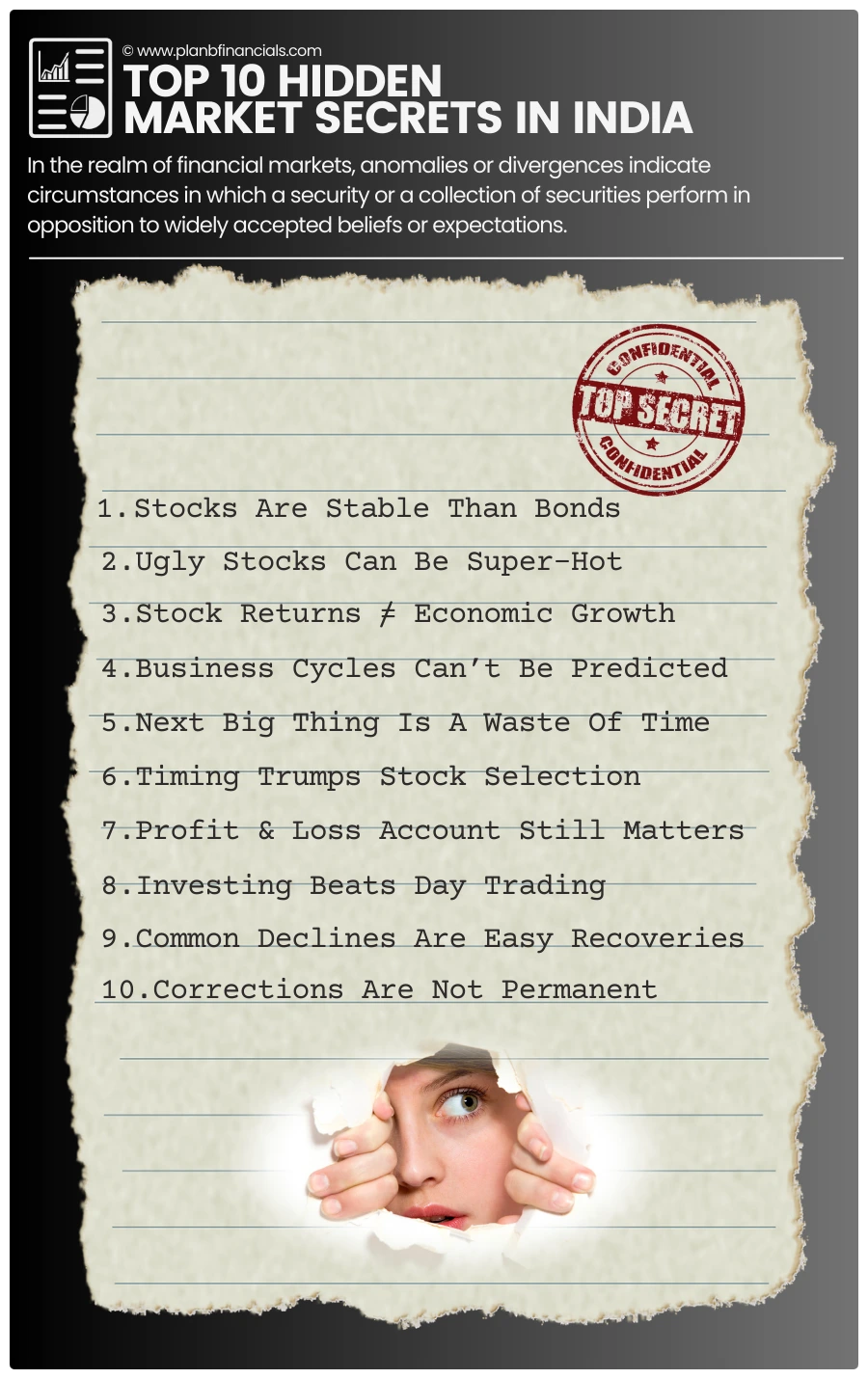

Gain an edge in the stock market investing by uncovering hidden insights that only a select few are aware of. This list of the ten insider stock market secrets will empower you with valuable knowledge and strategies to thrive in the world of investing.

In this Article

ToggleThe Context

Wisdom is not a product of schooling but of the lifelong attempt to acquire it — Albert Einstein

Conventional wisdom and entrenched beliefs often shape the behavior of most stock market participants. These ideas are widely accepted and seldom challenged, which can be problematic when false assumptions gain traction.

This can hinder the exploration of new ideas and impede investment returns, regardless of the investment strategy.

We have been attempting to align stock market trends with modern investment literature for almost a decade, but have often noticed significant discrepancies.

As a result, we have compiled a list of the top ten facts that challenge some long-standing theoretical norms in the evolving realm of investing.

1. Stocks Are Stable Than Bonds

While Bonds are a good way to diversify a portfolio, there are plenty of times when bonds can be riskier than stocks.

At the top of our list of market secrets is the comparison between stocks and bonds, which may surprise some readers. Risk is an inherent part of investing, and typically, investors must take on more risk to achieve higher returns. Many believe that bonds are a safer alternative to stocks, but the reality is quite different.

Although stocks can be volatile in the short run, they are the most stable asset class over extended periods, and historical data has shown that stocks generally outperform bonds in the long run. While bonds can help diversify a portfolio, there are situations when they can be riskier than stocks.

Risks Associated with Bonds–

☑ Interest Rate Risk – The possibility of falling bond prices due to rising interest rates. It is important to assess a bond’s duration based on the outlook for interest rates before investing.

☑ Credit Risk – The risk of default when an issuer is unable to make interest or principal payments on time.

☑ Inflation Risk – The risk of reduced purchasing power of a bond’s future coupons and principal due to inflation.

☑ Reinvestment Risk – the possibility of having to reinvest coupon income and principal at maturity at lower rates during a period of declining interest rates.

☑ Liquidity Risk – The risk of facing difficulty in finding buyers when selling bonds, which could lead to selling at a significant discount to market value.

While bonds can offer diversification, investors should also consider investing a substantial portion of their assets in stocks to achieve long-term investment objectives.

2. Ugly Stocks Can Be Super-Hot

Merely because a firm is frequently in the news doesn’t necessarily make it a wise investment choice. Humans are inherently wired to seek social acceptance and exhibit superiority, which can lead us to favor flashy brands and accessories. However, the same principles don’t apply to stock investing.

In reality, unappealing, tedious, and unremarkable companies can often have greater potential to outperform their glamorous counterparts. Here are some 10-year return examples from Indian stock markets to corroborate this fact-

☑ TTK Prestige (#TTKPRESTIG) has delivered 40 times return on Pressure Cookers

☑ Cera (#CERA) has delivered 41 times returns on Sanitaryware

☑ Relaxo (#RELAXO) has delivered 123 times returns on Flip-flops

☑ Symphony (#SYMPHONY) has delivered 883 times returns on Air Coolers

A company with a fancy name or its indulgence in a trending activity doesn’t give birth to a profitable business.

3. Stock Returns & Economic Growth

It may seem counterintuitive, but there is often an inverse relationship between stock returns and the growth of the economy. While it is commonly believed that the stock market serves as an indicator of economic health, the two are often not related at all.

On a theoretical level, it seems like the stock market should rise along with a strong economy. However, in practice, this is often not the case. Here’s why:

☑ Markets are forward-looking and most of the time they price in the effect of the recession that creeps after the boom

☑ Great publically listed companies, that are usually part of the indexes can retain their profitability during phases of downturns

☑ During extremely low interest rates and chaotic economic scenarios, high-net-worth investors who were once investing in bonds rush to shift their capital toward stocks

☑ Sectorial anomalies are real! This aberration has been noticed time and again throughout the history of stock markets.

A recent example was the steroidal boom of the IT and pharma sector during the COVID-19 crisis.

4. Business Cycles Can’t Be Predicted

At number four on our list of top 10 stock market secrets is the illusion of prediction.

In attempting to predict stock market performance by analyzing real economic activity, precision has yet to be achieved. Despite significant expenditures on business cycle forecasting, results have been unsatisfactory. For most retail investors, such an endeavor would be futile.

While staying informed about market trends can aid in making sound investment decisions, trying to predict the business cycle is statistically pointless. Economists and analysts have difficulty forecasting when the next recession will occur due to the complexity of predicting business cycles.

Instead, retail investors can focus on becoming financially literate and developing as their own financial authority and decision-maker. In summary, we rest our case.

5. Next Big Thing Is A Waste Of Time

Many investors are often on the lookout for the next big thing, such as the next Apple or Amazon, but this quest can come at a cost. The opportunity cost of waiting for the next multi-bagger can mean missing out on compounded returns from common equities that are readily available.

While it’s true that mid-cap and small-cap stocks have the potential to become ten or twenty-baggers, the uncertainty of identifying which ones and when makes it a risky strategy. Instead, generating continuous returns from the movement of common stocks is a more reliable approach.

The allure of the next big thing may be tempting, but it’s important to weigh the potential gains against the opportunity cost of waiting.

6. Timing Trump Stock Selection

A key factor in realizing real returns from your investments is timing, regardless of how impressive the company or stock may seem.

Many investors tend to overlook the significance of waiting for the right moment to invest in a great company. Investing in a stock at its highest valuation can prove to be a grave mistake. Stock prices tend to follow the principle of mean reversion, where prices eventually tend to revert to their average levels. This creates a window of opportunity to purchase the stock at a more reasonable price.

It is crucial to become familiar with a stock’s fair value and wait for the ideal moment to invest strategically. Our classes can help you learn more about simplified valuation concepts and make better investment decisions.

7. P&L Account Still Matters

Your wealth is at risk if you rely too heavily on graphs, ratios, reports, and professional reasoning.

The real prize hides in the plain old profit and loss (P&L) statement. The very existence of business banks on profits. Abusive mathematics draws an investor’s attention away from the crucial elements.

The profit and loss account provides information about an enterprise’s income and expenses which then translates to net profit or a net loss. As other variables help fine-tune the stock selection process, it’s the P&L that decides the worthiness of an investment.

8. Investing Beats Day Trading

This stock market advice ought to be obvious. Unless you are a full-time, experienced trader, the long-term investment will almost always result in better profits.

While trading seems fascinating from a short-term horizon the variables involved here are always unfair to help generate consistent profits over the long term. Unlike Investing where fundamentals dominate the game, Trading involves technical analysis to capitalize on market psychology and inefficiencies.

“The success rate of day traders is expected to be about 5% while individual investor underperforms a market index by 1.5% per year. Active traders underperform by 6.5% annually” – Rolf, Tradecity.com

How is it possible for someone to hope to earn a consistent living in this manner?

9. Common Declines Are Easy Recoveries

Stock market crash statistics pulled from historical data show that the most commonly experienced market declines are the easiest to recover from, especially when compared to bigger pullbacks – Guggenheim Investments

Stock market declines of 5% to 10% generally require a month’s recovery time.

A drop of 10-20% usually takes four months of recovery, while a 20-40% decline takes 15 months. When it comes to full-blown stock market crashes, like the one in 2008, the full average recovery time may exceed 120 months (10 years).

10. Corrections Are Not Permanent

Stock market corrections are common occurrences that happen every couple of years. These corrections are characterized by a market decline of more than 10% but less than 20%, which is significant but not quite enough to start a bear market.

In the US, the S&P 500 has experienced 13 corrections since 1980, with an average length of 3 months and an average decline of 14.8% in stock market value percentage. While declines that surpass 20% have only happened five times during the same period.

In India, the Nifty saw a steep fall of 38% from its high of 12,363 on January 14, 2020, to a low on March 23, 2020, but quickly rebounded to new heights. This was not the only significant correction in the Nifty, as there have been 18 instances since 2006 where the Nifty corrected more than 10%.

☑ May 2006 — June 2006, the decline of ~30%, took 6 months to recover

☑ February 2007 — August 2007, the decline of ~15%, took 3 months to recover

☑ January 2008 — April 2009, the decline of ~60%, took 34 months to recover (Great financial crisis triggered by the collapse of Lehman Brothers)

☑ November 2010 — August 2011, the decline of ~17%, took 36 months to recover

☑ July 2011 — April 2012, the decline of ~17%, took 15 months to recover

☑ October 2011 — June 2012, the decline of ~15%, took 3 months to recover

☑ October 2015 — August 2016, the decline of ~16%, took 8 months to recover

☑ January 2020 — March 2020, the decline of ~38%, took 4 months to recover

Data Source: Moneycontrol

The inferences from the above data suggest that the average recovery from the worst market crashes over the past 16 years stands at nearly one year and three months at best.

Conclusion

In conclusion, while conventional wisdom provides us with the theoretical foundation of stock market investing, it is practical knowledge that allows us to truly grasp the intricacies and nuances of the market. Through experiential learning, we can validate traditional ideas and adapt them to the real-world complexities of investing.

The Top 10 Insider Stock Market Secrets we have shared are not investment advice, but rather insights to spark curiosity and encourage exploration.

We invite you to share your own experiences and adventures in the stock market, as there is always more to learn and discover.

🔔 Investing is expensive, but leaving comments on this blog is free!

3 Comments

The knowledge here never ceases to amaze me. You guys are truly doing a great job. Keep sharing your experiences.

Can I simply say what a comfort to find someone that actually understands what they’re discussing on the net? You actually realize how to bring a problem to light and make it important. More and more people really need to read this and understand this side of the investing story.

Elijah, we appreciate your humble sentiments. We’re happy you’ve found our blog.