In this special guide, we’re going to dive into the world of investing and show you why it’s essential to keep an eye on the current value of your investments. We’ll talk about traditional methods like P/E ratios and why they have limitations. More importantly, we’ll introduce you to a powerful tool called cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E ratio that can help you better understand the value of what you’re investing in.

In this Article

ToggleThe Context

Have you ever heard the saying, “Slow and steady wins the race”? Well, when it comes to investing, this saying holds a lot of truth. Small, regular investments can be like tiny seeds that grow into big money trees over time. But there’s a catch – you need to know if you’re buying things at the right price.

At our core, we prioritize academic works that are essential for self-directed investors. We recognize that for regular investors, one critical method to accumulate wealth through investing is by making small, frequent investments.

Keeping up with the current market value can hence help you avoid overpriced assets and maximize profits. This exclusive guide is dedicated to this topic, so continue reading for more information.

Traditional methods for assessing stock value, such as price-to-earnings (P/E) ratios, have been commonly used by investors. However, these measures can be volatile and provide only a short-term view of market valuations.

P/E ratios are calculated by dividing the current stock price by the estimated earnings per share (EPS) over the next four quarters, which may not be ideal for value investing purposes. On the other hand, the cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E ratio, provides a longer-term view of market valuations, smoothing out the effects of short-term fluctuations in earnings and the business cycle.

What is the Shiller P/E Ratio?

The Shiller PE ratio was developed by Nobel Prize-winning economist Robert Shiller and is based on his work on stock market volatility and asset prices. It is a variant of the traditional P/E ratio that accounts for inflation and adjusts for cyclical fluctuations in earnings.

The Shiller P/E ratio is calculated by dividing the current stock price by the average inflation-adjusted earnings of the company over the past ten years. This measure provides a long-term perspective on stock market valuations, as it smooths out the effects of short-term fluctuations in earnings and the business cycle.

The Significance Of Shiller P/E Ratio

This ratio can provide you with a more comprehensive view of market valuations compared to traditional P/E ratios. You see, the traditional P/E ratio is calculated by dividing the current stock price by the company’s earnings per share (EPS) over the past year. This measure can be volatile and does not take into account the effects of cyclical fluctuations in earnings.

In contrast, the Shiller PE ratio accounts for the long-term trend of earnings growth and provides a better understanding of whether the market is overvalued or undervalued relative to historical levels. By using a ten-year average of earnings, the Shiller PE ratio smooths out the effects of short-term fluctuations and provides a more accurate view of the company’s earnings potential.

How to Use the Shiller P/E Ratio

You can use the Shiller PE ratio to evaluate whether the stock market is overvalued or undervalued relative to historical levels. A high Shiller PE ratio may suggest that the market is overvalued and due for a correction, while a low Shiller PE ratio may indicate that the market is undervalued and may present a buying opportunity.

Historical data has shown that the Shiller PE ratio has a strong correlation with future market returns. When the Shiller PE ratio is high, future market returns tend to be lower, and when the Shiller PE ratio is low, future market returns tend to be higher. In current years, the Shiller PE ratio in India has been high, indicating that the market could be overvalued.

As of March 31, 2023, the Shiller PE Ratio of BSE/NSE was 24.29, exceeding its historical average median range of 15-16. Further analysis reveals that over the past 11 years, the BSE’s Shiller PE Ratio wildly fluctuated between 11.31 and 55.04, with a median of 29.14.

These figures suggest that the market may be slightly overvalued compared to its historical mean and could undergo a minor correction.

However, it’s crucial to keep in mind that past trends may not always predict future market performance. While the Shiller PE ratio is a valuable indicator, investors should assess various other factors when analyzing market trends.

How to Calculate Shiller P/E Ratio?

Let’s also assume the current CPI inflation in India is 6% and the average inflation rate for the past 10 years is 4%.

Now, let’s say we want to calculate the cyclically adjusted price-to-earnings (CAPE) ratio for a company with a current stock price of Rs. 500 per share, and its earnings per share (EPS) over the past 10 years are as follows: Year 1: Rs. 5.00; Year 2: Rs. 5.50; Year 3: Rs. 6.00; Year 4: Rs. 6.50; Year 5: Rs. 7.00; Year 6: Rs. 7.50; Year 7: Rs. 8.00; Year 8: Rs. 8.50; Year 9: Rs. 9.00; Year 10: Rs. 9.50

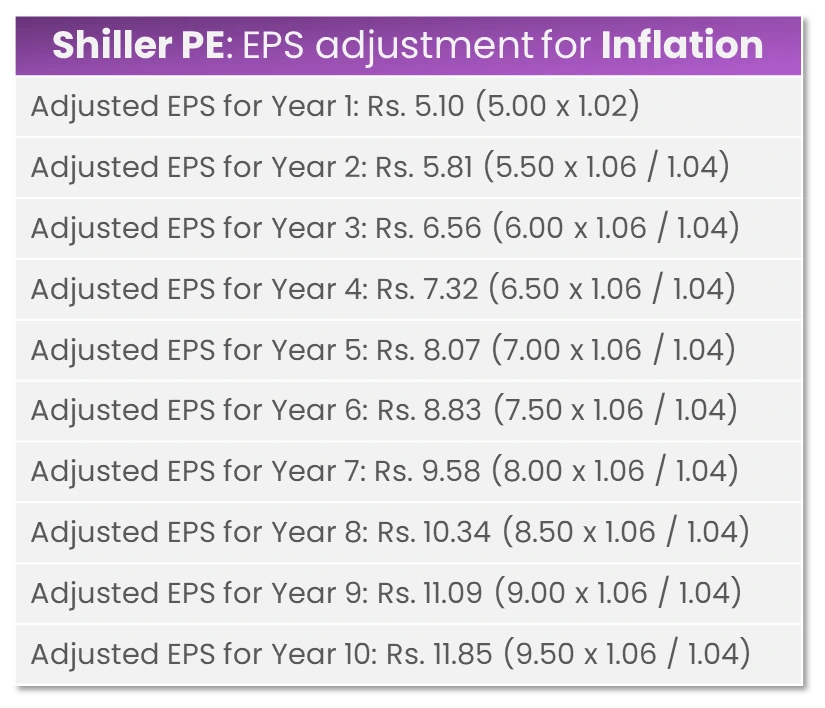

To calculate the cyclically adjusted earnings (CAPE), we first need to adjust the EPS for inflation. We do this by multiplying the EPS for each year by the ratio of the current CPI inflation to the CPI inflation in the year for which the EPS was reported.

For example, to adjust the EPS for year 1, we multiply it by (1 + 6%) / (1 + 4%) = 1.02.

Next, we calculate the 10-year average of the adjusted EPS:

10-year average adjusted EPS = (5.10 + 5.81 + 6.56 + 7.32 + 8.07 + 8.83 + 9.58 + 10.34 + 11.09 + 11.85) / 10 = Rs. 8.17

Finally, we calculate the CAPE ratio by dividing the current stock price by the 10-year average adjusted EPS:

CAPE Ratio = Rs. 500 / Rs. 8.17 = 61.13

So, in this example, the CAPE ratio for the company is 61.13, which suggests that the stock may be overvalued compared to its historical earnings.

Test it out yourself for a clearer understanding.

How Does It Fair Better?

While most investors rely on the traditional price-to-earnings ratio Ratio which has been covered at length in our dedicated write-up, the Shiller PE ratio is considered to be a better indicator of market valuations than the traditional P/E ratio for several reasons.

Here’s some food for thought to help you with your judgment.

≡ Accounts For Cyclical Fluctuations

The traditional P/E ratio is calculated by dividing the current stock price by the company’s earnings per share (EPS) over the past year. However, earnings can be volatile and subject to cyclical fluctuations that can distort the true picture of a company’s earnings potential.

In contrast, the Shiller PE ratio accounts for cyclical fluctuations by using a ten-year average of earnings. By averaging earnings over a longer period, the Shiller PE ratio provides a more accurate view of the company’s earnings potential and a better understanding of whether the market is overvalued or undervalued.

≡ Adjusts for Inflation

This measurement adjusts for inflation by using inflation-adjusted earnings, which are also known as real earnings. Inflation can distort earnings and make it difficult to accurately compare earnings over time. By using inflation-adjusted earnings, the Shiller P/E ratio provides a more accurate view of a company’s earnings potential over the long term.

≡ Provides a Longer-Term View

The traditional P/E ratio provides a snapshot of a company’s earnings potential over the past year. However, this short-term view may not provide a complete picture of the company’s earnings potential or the market’s long-term trend.

The Shiller PE ratio provides a longer-term view by using a ten-year average of earnings. This longer-term view can provide a better understanding of the market’s long-term trend and whether the market is overvalued or undervalued.

≡ Correlates With Future Returns

Historical data has shown that this ratio has a strong correlation with future market returns. When the Shiller P/E ratio is high, future market returns tend to be lower, and when the Shiller PE ratio is low, future market returns tend to be higher.

In distinction, the traditional P/E ratio has a weaker correlation with future market returns, as it provides a snapshot of a company’s earnings potential over the past year.

Conclusion

The Shiller PE ratio is considered to be a better indicator of market valuations than the traditional P/E ratio due to its ability to account for cyclical fluctuations, adjust for inflation, provide a longer-term view, and show a strong correlation with future market returns. Nonetheless, investors should use the Shiller PE ratio in unanimity with other metrics and a thorough analysis of individual companies and market trends to make informed investment decisions.

Congratulations on mastering the art of calculating the Shiller P/E ratio, which we hope has provided you with valuable insights for your future investments.

At PlanB Financials, our mission is to empower you with the knowledge and tools necessary to achieve your financial goals. To improve your financial literacy and guide you toward financial success, we offer a wide range of resources, including interactive courses, informative articles, and other valuable resources right at your fingertips.

Invest wisely!