Life is full of uncertainties, and planning for retirement can feel overwhelming. However, armed with the right information, you can ensure your financial future is secure. In this blog post, we’ll uncover the five critical variables that can influence your retirement strategy and offer expert guidance to steer you through them effectively.

In this Article

ToggleThe Context

Often when you think you’re at the end of something, you’re at the beginning of something else – Fred Rogers

Humanity relies on optimism and hopes to survive, and we all prefer to enjoy every moment of life to the fullest until all of our resources are depleted.

While this is as it should be, some forethought is also necessary to make the fun linger a little longer. Planning for retirement is a proactive choice that primarily depends on five unknowable factors.

These unknowns are so important that they have the potential to ruin your retirement plan without any room for adjustments down the road. According to research that was published on the prestigious news website Financial Express, only 27% of Indians are financially literate, and there is one financial advisor for every 17,000 individuals.

In addition to the 1:17000 ratio, hiring a SEBI-registered financial advisor often costs between ₹ 6,000 and ₹ 40,000. Many people just refuse to use these services to save money now, only to get burned later. In our opinion, this expense is rather justified in light of the risks involved, particularly if you are unsure of what you are going to do about your retirement.

Whether you are working with an advisor or working with yourself, your ability to fortify your retirement strategy depends on how well you understand and integrate these five missing variables into your retirement calculations.

Rate Of Return

The rate of return on your retirement corpus is the most important supposition that every retirement strategy should consider. This makes sure you have adequate money that has been appropriately extrapolated for your retirement years. Most experts derive this number basis their educated guesses which are officially known as the “assumed rate of return”.

The higher the assumed rate of return, the fewer contributions you will have to make toward your retirement plan. The lower it is the higher contributions need to be managed to receive anticipated benefits. The biggest mistake most individuals commit while designing their retirement strategy is to infer linear historic averages of various asset classes to assume future returns.

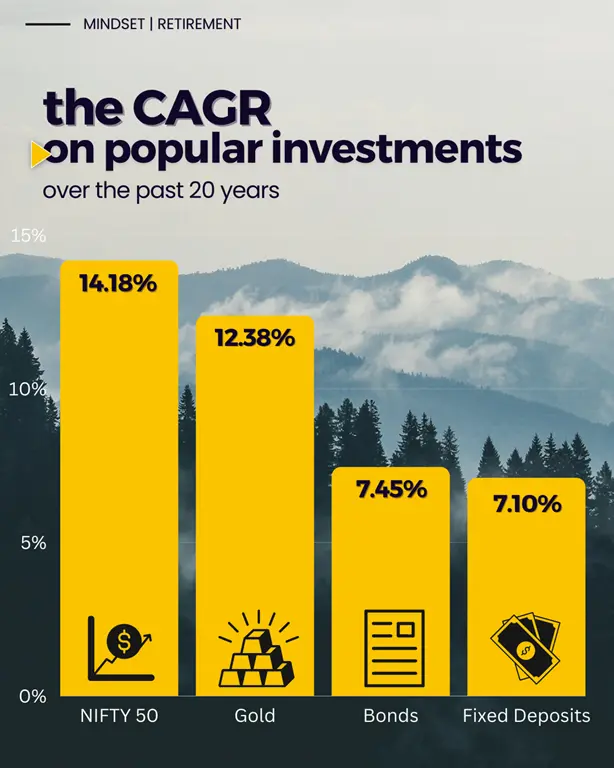

For instance, the CAGR on popular investments over the past 20 years are as follows –

While it is comfortable to assume that an equal mix of capital distributed across all of these asset classes can produce a CAGR of 10.3% over longer periods, this strategy is largely dormant and is easily influenced by a variety of unrefined factors, such as mental biases, financial knowledge, and current bull-bear scenarios.

Do bear in mind that because all financial markets experience exponential change, by the time you retire, some of the variables that may affect your returns may no longer be in effect. As a result, you should carefully include the proper rate of return based on the pre-determined asset mix in your retirement plan.

Many Indian experts suggest that a retirement portfolio has a cautious permanent rate of return of 6% (not a flat one), but you should modify it every year based on your investing experience, financial security, level of participation, and evolving economic conditions.

Inflation

The next area of concern when creating a retirement portfolio is inflation. It is the financial world’s most neglected enemy. Inflation is impossible to forecast and has a varied impact on every investor. Because the majority of retirement strategies are developed in the present, the results in the future frequently diverge significantly from the original plan.

This is just a result of the fact that your present living expenses will be significantly higher at retirement due to rising costs. For instance, prices for things like electricity bills, healthcare costs, transportation costs, and even your food won’t be the same as they are now. Over the previous 60 years, blended inflation has generally been around 7.5%. However, no one can predict for sure if it will still be the same in the next 20–30–40 years.

Medical inflation for instance climbs at a rate of about 14% year over year and, most retirees will still need to pay for it. With this in mind, you should take into account current inflation rates at slightly higher levels. This is to make sure your retirement corpus is strong enough to sustain you for the two to three decades you plan to spend in retirement.

Spending

Spending is a very vague yet crucial economic factor in retirement. Many retirees do find that their expenses go down, but in some cases, they might go up messing with your golden years.

The most common expenses that are presumed to go down include transportation, retirement contributions, life insurance premiums, food, clothing, and housing EMIs (if you retire with one debt-free property that you intend to live in).

On the opposite, the expenses that might go up after retirement would be your medical costs, self-care expenses, help for hire, and utilities such as heating/cooling bills. One should hence consider higher spending towards healthcare and lifestyle selections.

One common rule suggests people plan on needing about 70% to 80% of their pre-retirement income to pay the bills.

Taxes

Another unknowable factor that many people prefer to disregard in their retirement planning is the future tax implications. You can still make money even if you don’t have a steady job, thanks to investments like rent, capital gains, and interest. Each of these income streams is taxed as well. Your age and your income affect how much tax you pay.

Please be advised that annual incomes up to ₹3 lakhs are tax-free for individuals aged 60 to 80.

The following are the income tax rates for older Indian individuals with yearly incomes over ₹3 lakhs:

🖱 Between ₹3,00,000 and ₹5, 00,000, it’s 5% plus cess.

🖱 Between ₹5,00,001 to ₹ 10,00,000, it’s ₹10,000 + 20% (of total income – ₹5,00,000) + cess

🖱 Between ₹ 10,00,001 and above, ₹ 1,10,000 + 30% of (total income – ₹ 10,00,000) + cess

Income up to ₹5 lakh is exempt from tax for super senior citizens above 80 years of age. Hence, careful planning is required even before retirement if you want to lower your tax liability.

This can be achieved by planning capital shifts toward Tax-Free Bonds, Senior Citizen Savings Schemes (SCSS), and national Pension System (NPS) in parts and pieces. The major goal in this situation is to reduce transaction and capital management costs. It will be simpler for you to live comfortably if your income does not place you in higher tax rates.

Time

Time is the most misunderstood concept when it comes to retirement planning. The context of time for retirees is the portion of their lives during which they would require financial assistance from the retirement fund.

While it may seem fair to outlive your money since you can leave a piece to your heirs, going through the opposite is usually a nightmare.

It is also known as longevity risk.

People today are generally more aware and healthier, thus there is a bigger chance that they will outlast their money. People are living longer because they take better care of themselves and get more preventive care. Because of rising life expectancy and ever-rising inflation, a retiree’s nest egg should be sufficiently large to last an indefinite lifetime.

Going on the goodwill of others in your golden years is a challenge for many people, therefore it’s best to provide your corpus some endurance cover. To assist you in arriving at a reasonable figure, you should account for different interest rates, savings, and inflation when strategizing your retirement.

Additionally, you need to run sensitivity analyses to see how your finances might perform in the event of costly medical emergencies and circumstances like disability.

Conclusion

Many people frequently believe that retirement planning is a simple calculation. Retirement is thus frequently viewed as a trivial concept among young investors, but when you consider that our cognitive capacities tend to decline with age, you can see how integral retirement planning at an early age is.

Retirement planning is mentioned as being the most difficult financial issue by William Sharpe, who received the Nobel Prize for creating the capital asset pricing model (CAPM). This is because it is extremely difficult to anticipate lifespan, post-tax actual returns, insurance, and the trade-offs between goals and spending.

To land in the safe zone, it is best to make sure that no variable (especially the unknowns) is left untouched. Additionally, this calls for regular adjustments to these variables based on notable economic anomalies. This brings an end to the mindset episode that unfolds the mystery and implication of five missing variables of retirement planning.

We are devoted to supporting you in achieving financial success. To help you improve your financial literacy and accomplish your financial objectives, you’ll find a wealth of useful information, interactive courses, and other resources right here.

🔔 Investing is expensive, but leaving comments on this blog is free!