With the world’s money situation getting a bit shaky and uncertain, many people who invest their money are getting worried about something called a “recession.” In this blog post, we’ll look at the big signals that might show a recession is coming and what that means for your money.

In this Article

ToggleThe Context

I’ve heard there’s going to be a recession, I’ve decided not to participate — Walt Disney

After a protracted attack caused by the global epidemic, the regular business cycle appears to be losing pace. Fear of a recession now hangs over the prosperity that survived difficult times.

As market participants are entangled between fear and greed, the experts are debating mixed economic signals. An abrupt V-shaped market recovery during the year 2020 was followed by an extended euphoria that suggested perpetual prosperity. But then it seems as though the economic paradigm is veering off track.

This mindset story begins at the dawn of the year 2020. Apart from the disruptions to normal life, the COVID-19 pandemic started wrecking the world economy by March 2020.

The world’s governments decided to flood the markets with cheap money since there was too much to handle all at once.

For starters, cheap money is capital that is borrowed at low-interest rates to boost growth and consumption.

This last-ditch effort helped numerous economies stay afloat by absorbing a significant amount of shock. Many firms were able to grow on massive scales thanks to easy access to affordable capital. Production shattered all previous records, unemployment remained low, earnings increased, and spending reached new peaks of joy.

Everyone got lucky!

But the fundamental crisis was far from resolved. Simply put, the issue was relegated to the bottom of a usual economic cycle. Governments went into survival mode and reacted defensively as the fear of a downturn approached. Since lower interest rates make it inexpensive to borrow. This tends to encourage spending and investment and that leads to higher aggregate demand and economic growth. But this increase in demand also causes serious inflationary pressures. In easy words, the risk of a full-blown recession.

If you are anticipating a simple definition of the term Recession, there is none!

According to Monetarism (a school of thought), a recession is a direct cost of over-expansion of credit during expansion periods. It gets aggravated by insufficient money supply and credit availability during the initial stages of the slowdown.

Still with us!; Let us simplify.

Think of the current financial condition as a rubber band. Rubber bands expand when we pull on them; tugging them obnoxiously is ineffective and risky. When constant stretching breaches a tolerance zone, they snap!

The economic rubber band seems to have crossed the line of tolerance at this point. And increasing interest rates gradually (or quickly) is the only practical way to relieve this tension. However, many investors and individuals are wincing as a result of the pressing actions our governments have taken!

Traction In The Rubber Band

Interest rates and inflation rates are linked with each other. The higher the inflation rate, the more interest rates are likely to rise. This is simply because money lenders will demand higher rates as compensation to offset the impact of decreased purchasing power of the money they are paid in the future.

🇮🇳 In India, the average total inflation is set to accelerate to a nine-year high at 6.9% in FY 23. Inflation has now already breached the RBI’s upper tolerance rating of 6%.

After hiking the interest rates by 40 basis points (0.40%) in early May 2022, more aggressive and sequential rate hikes are said to be in motion. This will surely dampen the spirit of many investors in the months ahead.

🇹🇷 In November 2021, Turkey’s official currency, the lira, experienced a free fall, losing about a quarter of its value against the U.S. dollar. Turkey is now choked on a 70% inflation (a 20-year high).

🇨🇦 February 2022, Canada experienced an inflation rate of 6.8%, the highest since January 1991, exceeding the median estimate of 6.7% as per a Bloomberg survey of economists.

🇺🇸 March 2022, the inflation rate in the United States accelerated to 8.5%, the highest over the last 40 years.

🇬🇧 April 2022, UK inflation has reportedly gone up by 9%, the highest since 1982, another peculiar case of a 40-year-old high.

🇱🇰 In April 2022, Sri Lanka went bankrupt and is currently making the markets of the world very nervous.

🇵🇰 In May 2022, Pakistan recorded two-year high inflation of 13.37% as measured by the Consumer Price Index.

The majority of countries are now drifting from their historical mean and professional rating organizations are routinely sabotaging their growth estimates. Is this a short-term hiccup or an indication that the rubber band of the world economy is being stretched to its breaking point?

Let’s examine some ominous abnormalities!

The Anomalies

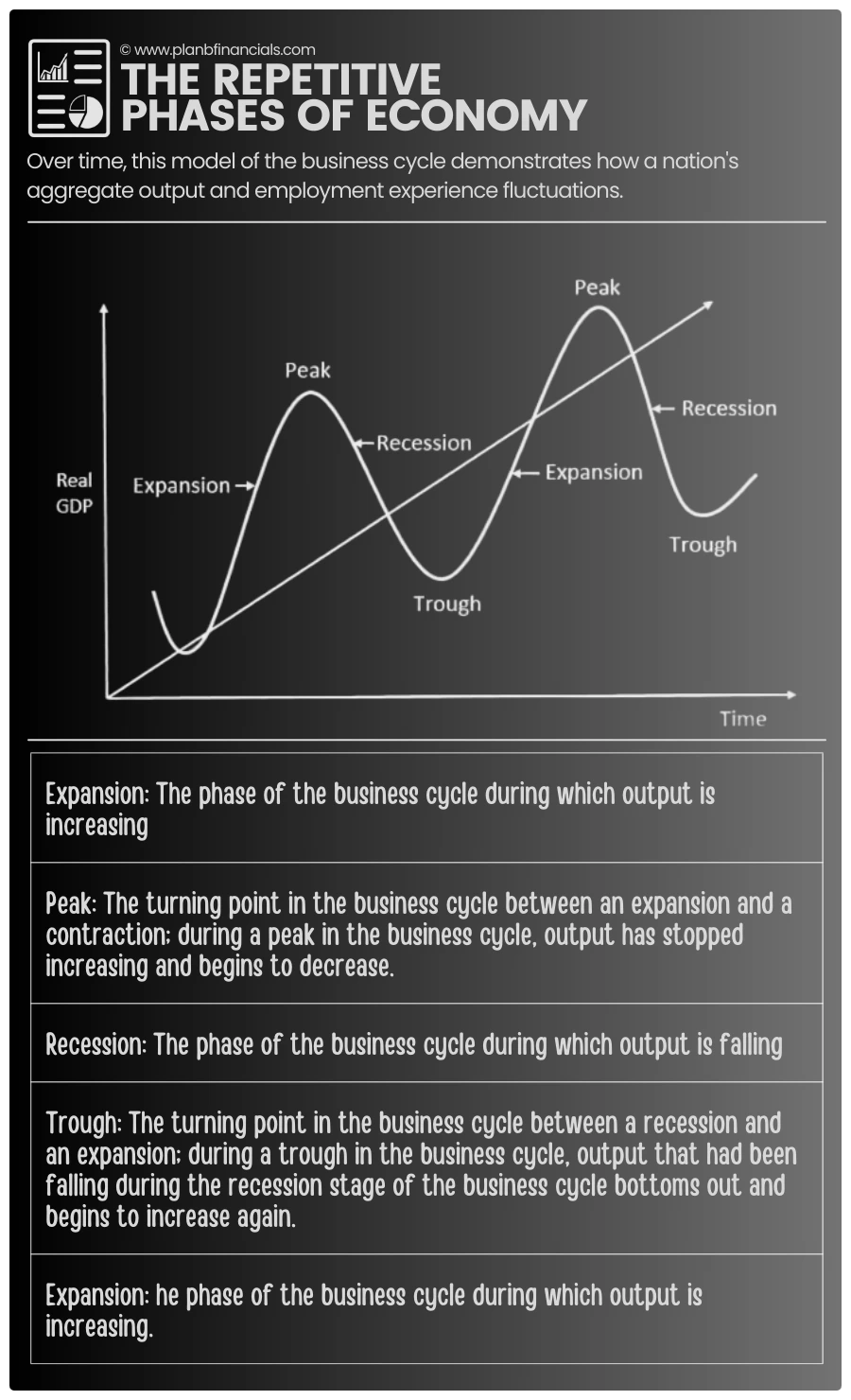

The expansion is considered a normal state of the economy, but when it reaches its Peak the fear of a recession starts lurking in the shadows. The business cycle peaks when economic growth reaches a point where it stabilizes for a brief period before reversing course.

The Peak can be ascertained by comparing the top-down economic activity with some long-established markers such as

High Employment & Rapid Expansion

As quoted by CIME – “The Indian labor markets saw substantially increased activity during April 2022. The labor force swelled and employment increased handsomely during the month. People seeking employment increased in large numbers and the Indian economy was able to provide additional employment in large numbers as well”.

FY 2021 had also been a wonderful year for prosperity where several sectors saw extraordinary employment growth. The IT sector can be a good example of accelerated growth where packed order books resulted in steep demand for talent. This led to frenzied job-hopping and high employee movements.

This phenomenon was dubbed the Great Attrition. During the first week of May 2022 however; the tech-heavy Nasdaq composite reported the biggest dip, after ending April 2022 with its worst monthly performance since the 2008 financial crisis.

Information Technology stocks in India have also corrected substantially since then, indicating a decline in overall market confidence. The validities are yet to unfold in the upcoming fiscal quarters.

Demand & Supply Variance

The auto sector in India turned out to have witnessed increased demand during FY 2021. Low cost of financing and ongoing prosperity lead to multifold growth in vehicle bookings. On the other hand, the acute chip shortages in the auto sector stirred the automotive supply chain across the world. The waiting period for buying new vehicles is currently running into months, and sometimes almost a year. Supply is simply not able to keep up with the demand!

India’s automobile production was reportedly steady in April 2022 as supply-related challenges continued to plague the sector. Although sales improved, the RBI’s recent repo rate hike (rate of lending money to commercial banks) reflected a drop in demand.

Bankruptcies & Foreclosure Risks

As per Insolvency and Bankruptcy Board of India (IBBI) data; 285 firms are destined to face bankruptcy proceedings in the first two quarters of FY 2022. If the interest rates keep rising at an aggressive pace, we might see additional bankruptcies in the coming months. India has the third-largest ecosystem for startups, yet 80% to 90% of Indian startups fail within the first 5 years of their inception.

Startups are usually built upon borrowed money. They tend to survive on the borderlines till they are successful. The current situation may very well evolve into a double whammy for these capital-intensive tots. High borrowing rates will build pressure on existing EMIs while rising inflation will diminish sales. This volatile situation can wreak havoc on the current business cash flows and thus question their survival.

Too Many Acquisition & Mergers

Amongst the doom, gloom, and chaos, the corporate sharks are on a killing spree.

☑ In January Reliance acquired Mandarin Oriental, a premium luxury hotel in New York, for an equity consideration of around $98.15 million. They also spent $132 million to pick up a 54% stake in Addverb Technologies, an Indian robotics startup. Also, as per news reports, Reliance is set to acquire dozens of niche brands in small grocery and non-food segments to target its own $6.5 billion consumer goods business.

☑ HCL Technologies has acquired a majority stake (51%) in German IT consulting firm Gesellschaft fr Banksysteme GmbH (GBS).

☑ Infosys has signed a definitive agreement to acquire Oddity, a German digital marketing, experience, and commerce agency.

☑ Indian giant Tata has acquired Air India (Aviation), BigBasket (Grocery), and 1mg (Pharma). The company is in acquisition talks with as many as 5 brands, to further bolster its position to compete with Reliance.

☑ Not to mention the Adani group which is buying everything that moves. The latest acquisitions were ACC India and Ambuja Cement from Switzerland-based Holcim for $10.5 billion.

These are just a few examples of measuring turbulence across the acquisition universe.

Unsold Real Estate Inventory

Unsold housing inventory across the top seven cities plunged to 32 months by 2021-end, compared to a 55-month overhang by 2020, according to data provided by Anarock Property Consultants. As per housing.com, builders in India are sitting on an unsold stock consisting of 7,35,852 units as of March 31, 2022.

This number stood at 7,05,344 units at the end of March of the previous year (a 4% increment Y-o-Y). With an individual share of 35% and 16%, respectively, Mumbai and Pune continue to contribute the most to this nationwide housing inventory.

Global Unrest

We are living in a networked economy, and the crisis in Russia and Ukraine has indeed jolted the world. War has triggered a worldwide oil shock followed by serious food shortages tipping the Economic Peak to the next level.

While Russia is the world’s largest exporter of oil and petroleum products; Ukraine is the world’s main breadbasket and accounts for a huge share of the globe’s exports in several major commodities like wheat, vegetable oil, and corn. When the globe had just begun to recover from the COVID-19 epidemic, this aberration was the least anticipated.

Some other oddities include:

☑ Rising unemployment, which currently stands at around 7.12% (May’22 exit).; as per CIME)

☑ Lower consumer spending

☑ Falling asset prices, and

☑ The sideways movement of stock markets with some abrupt descents

Conclusion

All things considered, the world and Indian economies are walking a tightrope. The majority of indications point to smoke emanating from our global economic factory. Recessions are detrimental to the economy and disastrous for investors. They can be of short and long durations and are usually accompanied by drags.

Comparable to nuclear fallout, drags are long-term consequences of a recession that can last for years or decades. The 2000 dot-com stock market crash reportedly impacted 8.7 million jobs in the US. It took about 7 years to recover from this crisis.

The last Great Recession began in December 2007 and ended in June 2009 which makes it the longest recession since World War II. The 2007 crash approximately totaled 8.8 million jobs as per the Bureau of Labor Statistics. It took almost 2 years for stock market indices to recover from this one.

Moreover, since 1966, there have been stock market crashes every 7 years. The aggressive interest rate increases are probably going to act as passive catalysts that will eventually cause many large ripples in the months to come.

Recessions build gradually in our economic system and they reveal themselves without a warning. Even though the majority of governments have backup and damage management plans to fall back on. It’s the common investors who are typically taken off guard, The accelerated post-pandemic abundance has enticed millions of novice investors to wager on their money by recklessly trading the markets.

The cheap money has also fueled the biggest-ever start-up boom in the past 2 years. With young entrepreneurs founding thousands of businesses on borrowed money, we could very well be sitting on a Desi (indigenous) version of a bubble that can become a full-blown recession.

Economists can’t tell you when the next downturn is coming. Expansions don’t die of old age: They’re murdered by bubbles, central bank mistakes, or some unforeseen shock to the economy’s supply (e.g., energy price spike, credit disruption) and/or demand slide (e.g., income/wealth losses).

—Jared Bernstein, Washington Post, July 5th, 2018.

Share your thoughts on these subtle indications of a recession in the comments section below.

🔔 Investing is expensive, but leaving comments on this blog is free!

2 Comments

I enjoy reading your articles. Please increase the frequency of your posts if possible.

Two straight GDP declines and bam…we are officially in a recession. Let’s see for how long this can be postponed with shock treatment. Deep down, several stocks are already experiencing a recession-like situation.