Find out how dividend stocks can be like a reliable money tap, continuously giving you cash without you doing much. In this blog post, we’ll talk about the top 10 dividend stocks you can put your money in. We’ll also explain what makes them special and how much money they might bring your way.

In this Article

ToggleThe Context

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in — John D. Rockefeller

Owning dividend stocks is a nice way to make money while you sleep!

A dividend refers to a part of the profit that a company shares with you as its shareholder. It’s a gift for your loyalty if you decide to stick with the business despite its ups and downs. Dividends can be issued in various forms, such as cash payment bonus stocks, etc.

A company’s dividend is decided by its board of directors and it requires the shareholders’ approval when they choose to exercise their voting rights. A business does not, however, have to always provide dividends!

Good companies that don’t pay dividends are often classified as growth companies and their listed stocks are referred to as Growth stocks. Such corporations usually prefer to use their profits to chase growth in the form of expansions, diversifications, or acquisitions. When spent well, the money reflects in the corporation’s book value and eventually the stock prices through capital appreciation in the long run.

Dividend stocks usually come from well-established companies with a proven track record of distributing earnings back to shareholders. The choice of building a dividend-heavy portfolio depends on the ongoing phase of an investor’s lifecycle.

Dividends provide certainty about the company’s financial well-being and they also double up in assembling passive income streams. Most retired or passive-style investors hence seek a dividend-heavy portfolio with little or no interest in emerging companies that still appear to be on their growth trajectories.

As a general rule, investors who are still young and have a lengthy time horizon for their invested cash to perform favor growth-heavy portfolios. We think that every portfolio, regardless of an investor’s age, requires a few dividend-paying stocks from a diversification standpoint.

Selection Criteria

Numerous standards can be taken into consideration to discover good dividend stocks. The foundation of our approach though is a set of fundamental ideas that we cover in our learning modules and put into practice. This list is sorted based on dividend returns, had you invested 10 years ago (FY13). Additional parameters taken into selection are as follows —

≡ Fundamentals — As basic as it sounds, virtuous company fundamentals ensure evenness in the long run

≡ Debt To Equity less than 0.4 — For the sake of showing compassion, it is pointless to accept dividends from a company that is already hunching on hefty debt.

Click to read more about this ratio

≡ Capital Recovery — A brief assessment of capital recovery via dividend payouts over the past 10 years ensures reduced risk of holding a particular stock for a long time

≡ Dividend Yield Of more than 3% — Consideration of a modest minimum dividend yield of 3 percent or more.

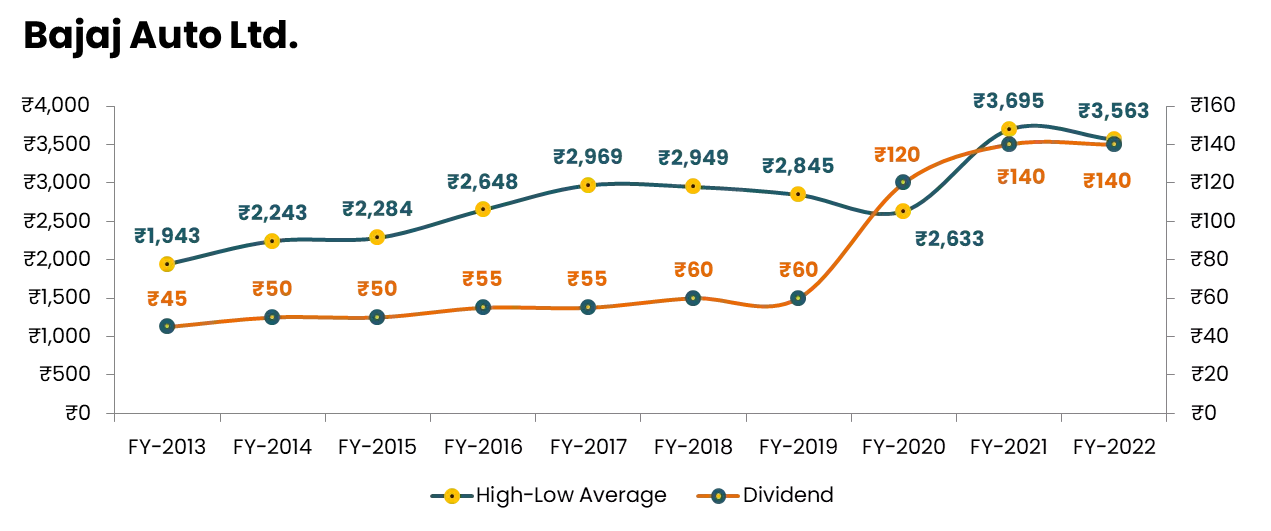

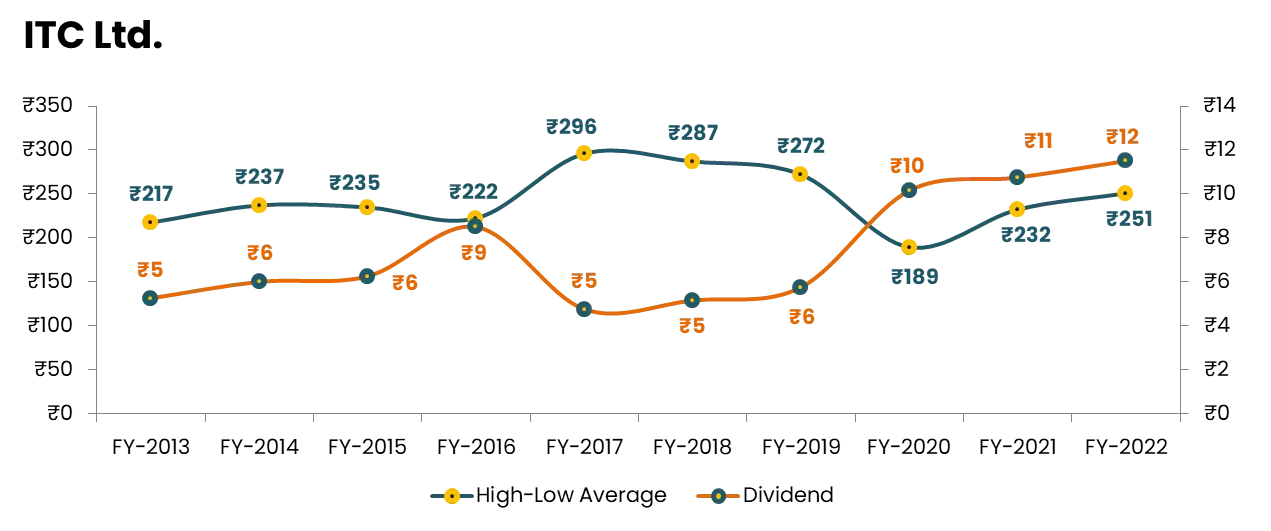

≡ Dividend Yield Calculation — The yield in our study is calculated on the average price derived from the annual peak and bottom price for each year during the last 10 successive years

≡ Shareholder Treatment — How a company treats its shareholders in the face of adversity says a lot about its reputation (see FY20 in the graphs below).

The COVID pandemic has been a good excuse and a justified reason for many companies to pocket dividends

≡ The Graph Plot — The price trend and the dividend yield to be examined in isolation for measuring the consistency of dividends against annual price variations

Here’s our list of the top 10 great dividend stocks that are listed on Indian stock markets.

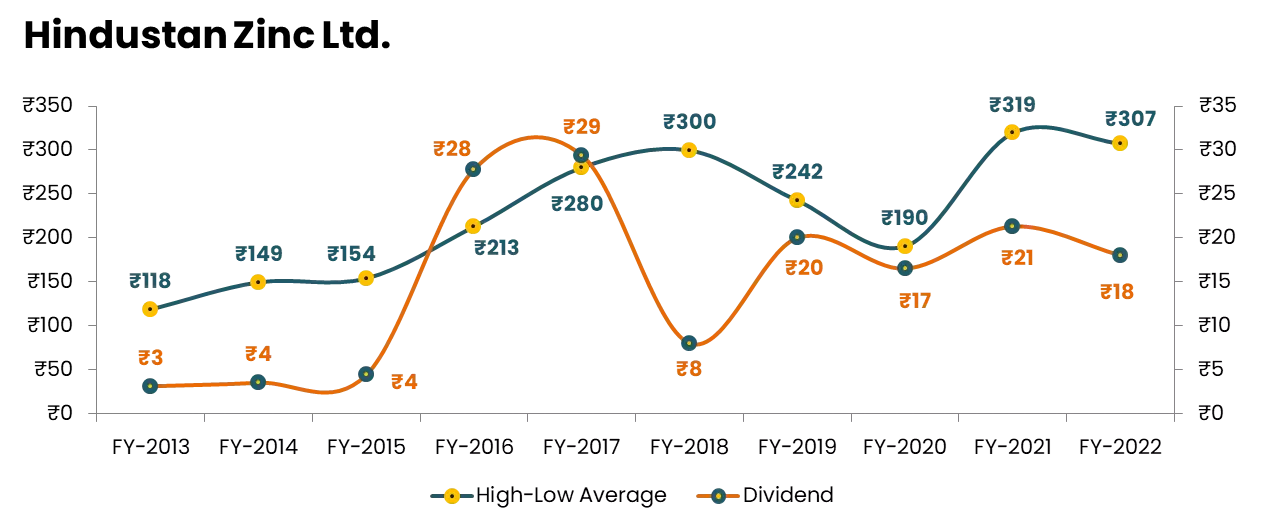

1. Hindustan Zinc Ltd

Incorporated in 1966, Hindustan Zinc has a rich experience of more than five decades in Zinc- Lead mining and smelting. It’s ranked #1 in the Metals and Mining Category in the Asia Pacific in the Dow Jones Sustainability Index 2019. This dividend stock is one of the lowest-cost producers of Zinc globally and it is India’s only integrated producer of Zinc, Lead, and Silver. Little would you know, this company is a subsidiary of Vedanta Limited which owns a 64.9 percent stake in it. The balance 29.5 percent stake is owned by the Government of India.

Zinc is usually considered to be merely an immunity booster, but with other worthy industrial applications of the metal, this stock has returned a massive 128 percent worth of your capital investment just through the dividends, had you invested in FY13.

Hindustan Zinc holds a dominant market position with a 77 percent market share in India’s primary zinc mining industry. Backward assimilation and low-cost high-grade zinc reserves make this company the lowest-cost producer of zinc worldwide.

Hindustan Zinc continues to explore & implement various best-in-class technologies and rational strategies to further strengthen its position as a low-cost producer of zinc. Hindustan Zinc has always favored a high dividend policy.

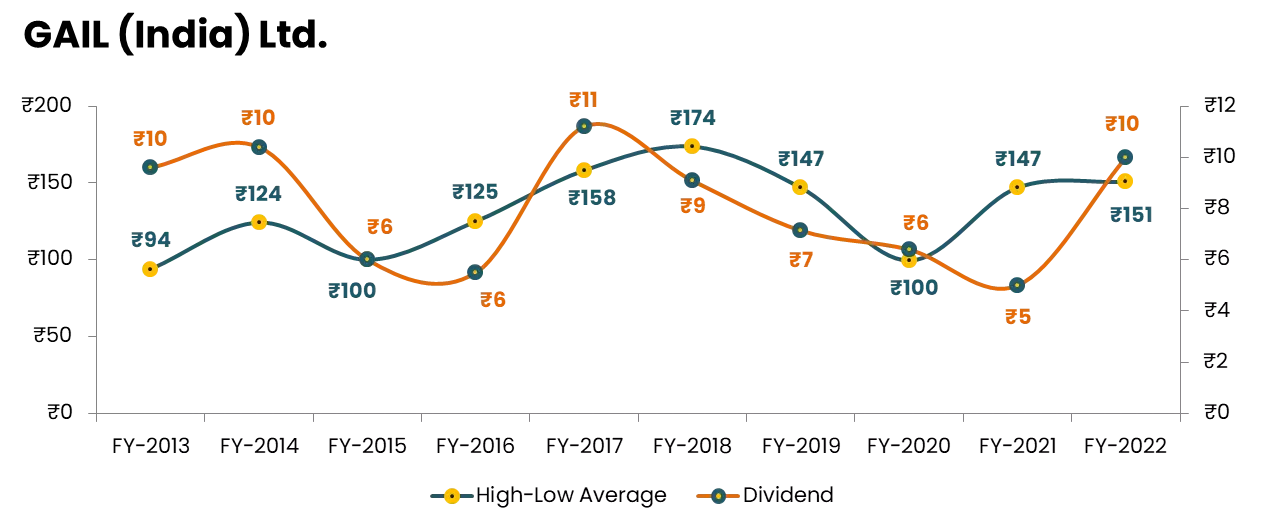

2. Gail India Ltd

Incorporated in 1984, GAIL, a Government of India undertaking, is an integrated natural gas company in India. It owns over 11,500 km of natural gas pipelines, over 2300 km of LPG pipelines, six LPG gas-processing units, and a petrochemical facility.

It also has a joint-venture interest in Petronet LNG Ltd., Ratnagiri Gas and Power Pvt. Ltd., and the CGD business in several cities. The stock, which is frequently dismissed as a dull Public Sector Unit (PSU), has conservatively repaid 86% of the cash that was invested back in the year FY13 in dividends.

GAIL has wholly-owned subsidiaries in Singapore and the US for expanding its presence outside India in the segments of LNG, petrochemical trading, and shale gas assets.

The setting up of gas pipelines requires large investments and navigating a complex regulatory framework. As a result, the entry barriers to the natural gas transmission business remain high.

This is a good moat for the company to sustain and survive in the long term. The Government of India (GoI) has focused on increasing the share of natural gas in the overall energy mix.

This will be increased to 15 percent from 6.5 percent currently and has thus resulted in the government taking several steps to increase natural gas consumption.

To diversify its revenue streams and utilize its ability to source natural gas efficiently, GAIL has also ventured into downstream sectors i.e. manufacturing of petrochemicals and liquefied petroleum gas (LPG).

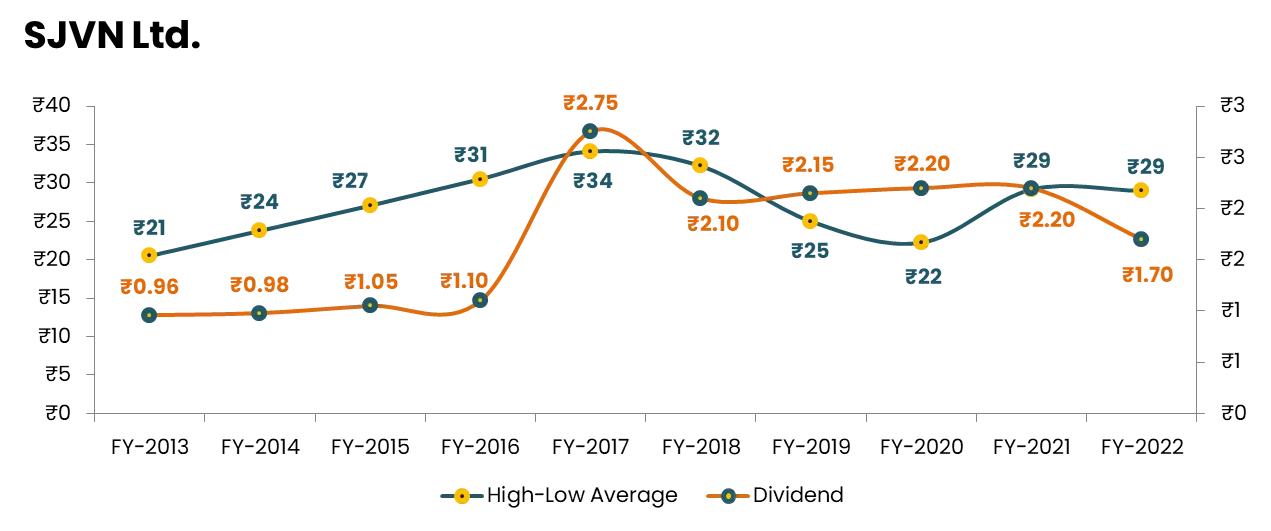

3. SJVN Ltd

SJVN is engaged in the business of Electricity generation. The company is also engaged in the business of providing consultancy for hydropower projects.

Often confused as a penny stock by many big-ticket investors, this stock has returned 84 percent of the capital that was invested back in FY13 in the form of paltry dividends to its shareholders.

Even though many big-ticket investors frequently mistake it for a penny stock. This business has returned 84 percent of the cash that was invested back in FY13 in the form of dividends to its shareholders.

Presently, the company has 5 operational electricity projects across India with a total capacity of ~2015 megawatts. They are –

- Nathpa Jhakri Hydro Power — 1500 MW; Himachal Pradesh

- Rampur Hydro Power — 412 MW; Himachal Pradesh

- Khirvire Wind Power — 47.6 MW; Maharashtra

- Charanka Solar Power — 5.6 MW; Gujarat

- Sadla Wind Power — 50 MW; Gujarat

The company has the vision to increase its electricity generation capacity to 5,000 megawatts by 2023, 12,000 megawatts by 2030 & 25,000 MW by 2040. The company is promoted by Govt. of India and Govt. of Himachal Pradesh.

As per the Articles of Association, the power to appoint directors vests with the President of India through the Administrative Ministry i.e., the Ministry of Power. The company has a stable revenue stream through long-term PPAs with state electricity boards and distribution licensees.

The company has various ongoing projects that are under construction, under pre-construction & investment approval, and survey and investigation. It has 4 projects under construction with 4 projects that are under pre-construction and approval along with 7 projects that are under survey & Investigation.

The total capacity of ongoing projects is ~5,570 megawatts.

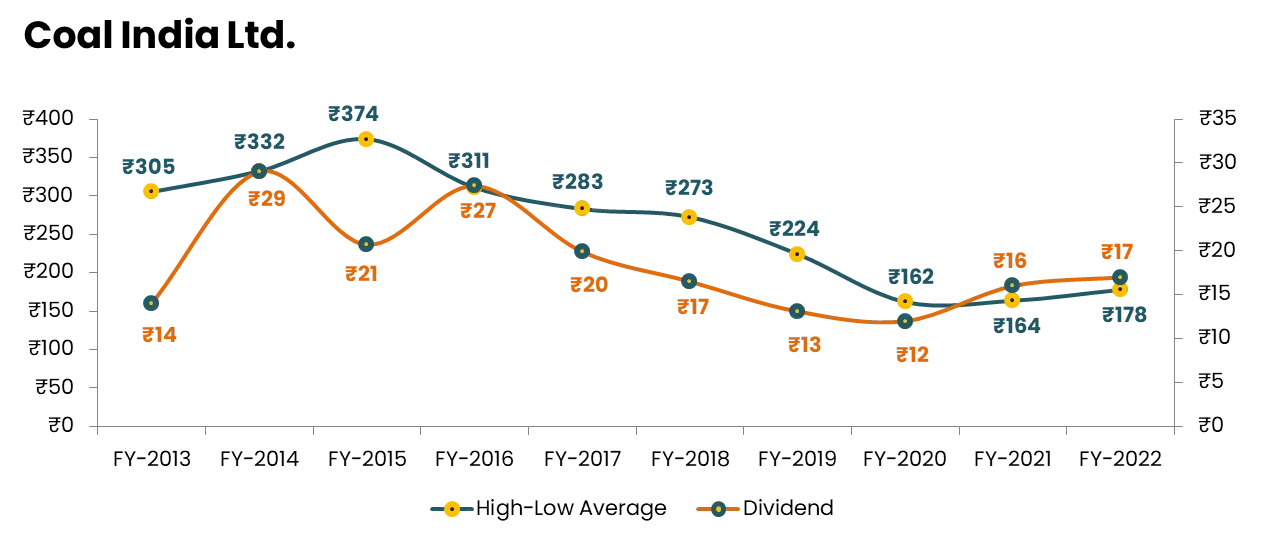

4. Coal India Ltd

Overlooking what they discourse in those gorgeous G20 summits, Coal India Ltd. is mainly engaged in the mining and production of Coal and also operates Coal washeries. The major consumers of the company are the power and steel sectors.

Consumers from other sectors include cement, fertilizers, brick kilns, etc. Surprisingly this dividend stock has been rebuked by many social media influencers for not generating YouTube-worthy returns!

However according to our analytics team, if you had invested in this business ten years ago (FY13), you would have, at the very least, received 61 percent of your initial investment back in dividends. Coal India was incorporated in 1973 as Coal Mines Authority Ltd. after the nationalization of the coal sector.

The company operates several coal mines in India through its 8 wholly-owned subsidiaries. The company was conferred the Maharatna status by GOI in 2011 and the status provided financial and operational autonomy to the company.

Coal is one of the primary energy resources and it accounts for 55 percent of commercial energy consumption. India is the 2nd largest producer of coal in the world producing about 729 million tons (Mt) of coal in 2019-20.

The share of coal is expected to remain high at 48-54 percent by 2040 and accounts for 76 percent of the total thermal power generating capacity of the Utility sector.

The Government of India; in June 2020 re-looked at the Foreign Direct Investment (FDI) Policy and the old 2017 rule was revised by the Central Government. The new rule now permits 100 percent FDI under automatic routes in coal mining activities, including associated processing infrastructure- for the sale of coal. The change in the FDI policy will increase the competition for Coal India and might bring down the high Market share of the company.

The Government brought this change due to the inefficiency of the existing coal miners in India. Despite having large reserves of coal, India imported 240 million tons of coal valued at around ₹1.7 lakh crore.

This step would certainly increase Domestic production and it would reduce coal imports substantially. In June 2020, for the first time, India opened up its 41 Coal blocks for commercial Mining. These auctions invite participants to mine coal blocks by bidding on the percentage value of coal sold that they will be willing to share with the government.

Successful bidders will obtain leasing rights from State governments to mine a coal block for a certain period.

Several large private saber-rattlers like the Adani groups, Vedanta Ltd., and many more companies have been showing interest in the Auction and this has recently intensified the competition for Coal India.

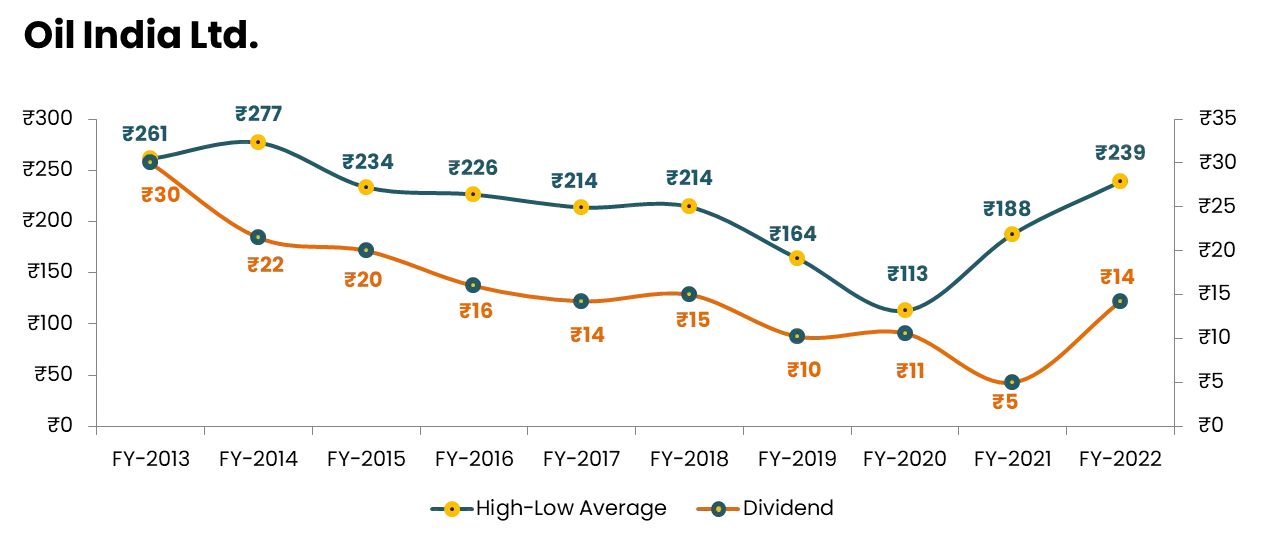

5. Oil India Ltd

Oil India Ltd. is engaged in the exploration, development, and production of crude oil and natural gas, transportation of crude oil, and production of LPG. It also provides various E&P-related services for oil blocks.

Oil has been a source of dispute for millennia owing to a variety of geopolitical factors, but if you had invested in it 10 years ago (in FY13), you would have, at the very least, received a 60% return on your investment in dividends.

Presently, the sale of crude oil accounts for ~76 percent of revenues, followed by Natural Gas (18 percent), transportation (pipeline) (~3 percent), and others (3 percent). The company currently owns a stake in 60 blocks in India and 12 blocks in overseas countries like the US, Nigeria, Venezuela, Russia, Bangladesh, and others.

As of March 2020, the company has 2P (proven and probable) reserves of ~75 million metric tons (MMT) and ~60 billion cubic meters (BCM) of crude oil and natural gas respectively. Its overseas 2P reserves are ~25 MMT and ~22.5 BCM of crude oil and natural gas.

The company operates pipelines of ~1150 km for crude oil and 660 km for multi-product, along with 23 percent equity in DNP Ltd. which has 192 km of established natural gas pipeline in Assam.

For the last few years, the average capital expenditure of the company has been in the range of 3,800-4,300 crores with

- ~25 percent expenditure on development drilling,

- ~22 percent on exploration drilling,

- ~24 percent on capital equipment,

- ~12 percent on overseas projects and

- ~15 percent on surveys and R&D.

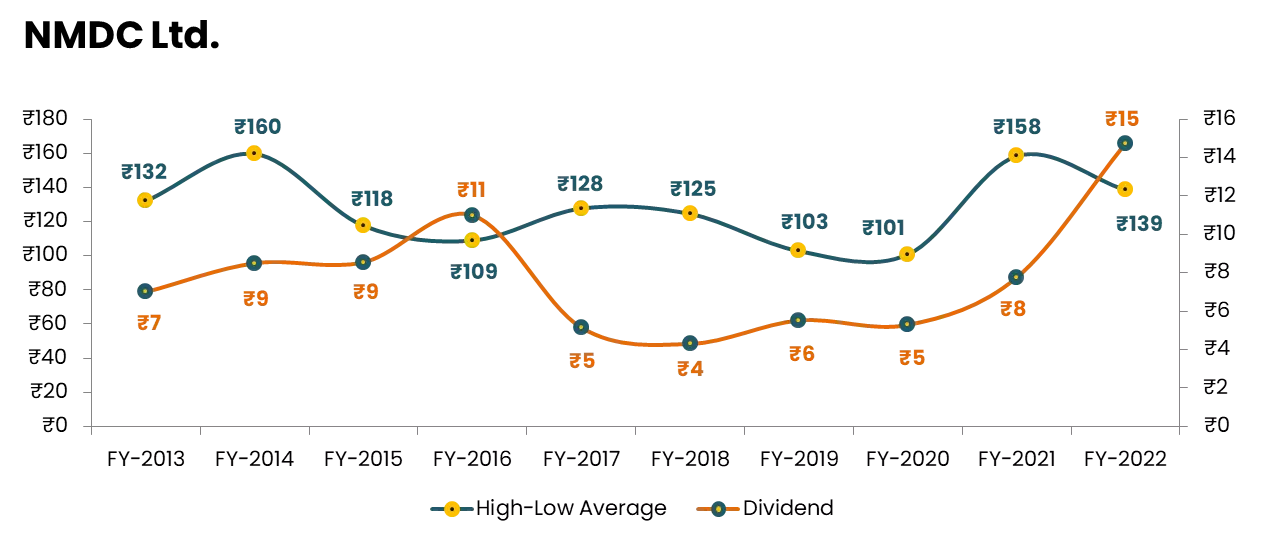

6. NMDC Ltd

NMDC is engaged in the exploration and production of Iron Ore along with Diamond, the production, & sale of Sponge Iron, and the generation & sale of Wind Power.

National Mineral Development Corporation (NMDC) was established in the year 1958 as a fully owned government company under the administrative control of the Ministry of Steel and is one of the most profitable ones among the Navratna companies.

Another Public Sector Unit (PSU), which has received criticism from several sophisticated investors, proudly paid out 59 percent of its capital as dividends to stockholders who committed to investing in this stock ten years ago (FY13).

NMDC is the largest iron ore manufacturer in India accounting for 18 percent of the total domestic production. The average annual production of the company stood at 17 million tons for the past 5 years. Production in FY21 was a massive 34 million tons.

The company has 7 Iron mines spread across India with a production capacity of up to 36 million tons per annum (MTPA). They supply iron ore in the form of lumps and fines to various steel manufacturing units and metallurgy Industries.

Further, the company’s mining licenses for 5 of its mines have been extended for another twenty years.

The company intends to increase its production capacity from the existing 43 MTPA to 67 MTPA by 2021-2022 and the company has committed a Capex of ₹2,491 Cr. to achieve the target. Mining rights come with many benefits hence the company also operates the only mechanized Diamond Mine in India at Panna, MP with an Annual production of up to 28,450 Carats.

NMDC has been allocated two coal blocks in Jharkhand and the company will start the operations of coal mining shortly.

NMDC holds a 92.3 percent stake in the Legacy Iron Ore Ltd based in Australia which is primarily focused on Iron Ore, Gold, and base metals, and the company holds 21 exploration tenements in Southern Australia. International Coal Ventures Ltd. is a joint venture between NMDC, SAIL, and RINL, and the venture acquired a coal mine in Mozambique where it produced 1.78 million tons of coal in the FY-20.

Metal mining is all about being cheap & best and NMDC is one of the world’s low-cost Iron ore producers. As an experiment, they have recently ventured into the steel-making business to benefit from their ability to procure Iron ore at a cheaper price.

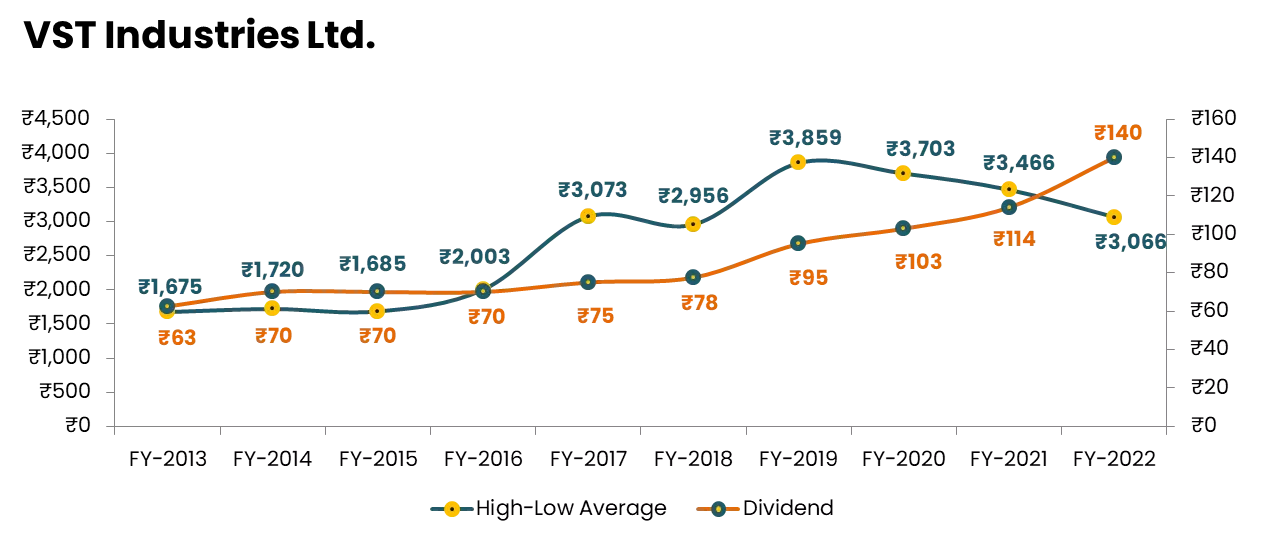

7. VST Industries Ltd

Smoking seems to be good for wealth as long as you are not the one on the other side of the stick.

VST Industries is engaged in the manufacture and trading of Cigarettes, Tobacco, and Tobacco products. Founded in the year 1930, VST Industries got its name through its founder Vazir Sultan.

They are the third-largest player in the Indian Cigarette Market with over 90 years of operations. The market share of VST Industries stands at 9 percent in the legal cigarette market and 5 percent in the overall cigarette market in terms of value.

This contender has conservatively returned 52 percent of capital to investors in the form of dividends who decided to invest in this scrip during FY13. VST Industries has a portfolio of reputed brands and it sells cigarettes in India and abroad under different brands including Charminar, Charms, Special, Moments, Total, and Editions.

VST operates mainly in the lower-end categories and the company sells cigarettes at different price levels ranging from ₹4 to ₹10 per stick. The company manufactures cigarettes and unmanufactured tobacco in its two manufacturing units in Hyderabad and Toopran, Telangana.

The company spends 0.53 percent of its sales on R&D. In the R&D division, the company focuses on developing quality blends with innovative filter variants for new brands, which have been well accepted by its loyal consumers in the marketplace.

What’s great for investors is that VST Industries hasn’t had any debts since 2003. Plus, they haven’t put their money into other companies; instead, they’ve used the money they’ve earned to grow their own business.

The company continues to modernize the manufacturing plant to enhance capital efficiency and optimize cost by providing innovative products to customers. VST derives most of its revenue from the southern and eastern states, now the company has forayed into the central states which would increase its market share.

Also, the company intends to enter into the higher tranche of the consumer segment by launching the 84 mm cigar under the brand Edition. Cigarettes are classified as sin goods under the GST regime and are currently taxed exorbitantly at 28 percent and an additional cess of up to 21 percent.

The high taxation on cigarettes has resulted in expanding the illegal cigarette market which is a threat to its business. Currently, the illegal market has a 28 percent share of the Tobacco Industry.

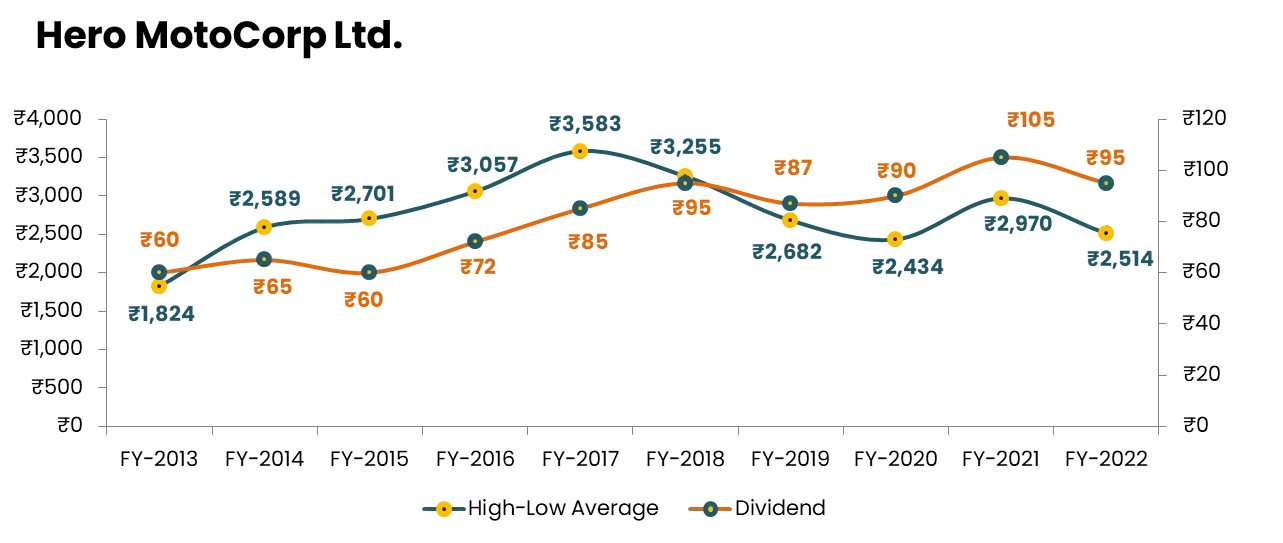

8. Hero MotoCorp Ltd

Hero Moto Corp earlier also known as ‘Hero Honda’ is one of India’s first motorcycle manufacturers.

If you had invested in this legendary stock during the year that the Indian Space Research Organization (ISRO) was busy launching project Mangalyaan (i.e. FY 2013), you would have received a 45 percent dividend return on your initial investment.

The company started in 1984 as a Technological collaboration with Honda, Japan. Before this collaboration, Hero was selling Cycles under the brand name, Hero Cycles. In 2011, Honda Group sold its 26 percent stake in the company to the Munjals (promoters) and ended the JV.

Post the termination of JV, the name of the company was changed to Hero Motocorp. It is the world’s largest manufacturer of 2 Wheelers, in terms of unit volumes sold by a single company in a calendar year, for 19 years in a row.

In FY 20 in the face of the pandemic, the company sold a massive 64 lakh two-wheeler units. Its sales have grown by 39 percent over the past decade. The company has some strong brands under its names like Splendor, Passion, and Glamour in the bike segment and Pleasure, Maestro in the scooter segment, and others, etc.

Hero boasts an assortment of 199 dealers and 25,500 retailers. It has tied up with Harley-Davidson under which it will develop and sell a range of premium motorcycles, accessories, and general merchandise under the Harley-Davidson brand name in India.

The Company has been focusing on expanding its business to EVs for which it has tied up with Ather (in which the company owns 34.58 percent as of July 2020) and with HeroHatch (an internal start-up). We have covered some more elements about Hero Moto Corp in our exclusive write-up on the Top 10 Indian Auto companies.

9. Bajaj Auto Ltd

Headquartered in Pune, Bajaj Auto, the flagship company of Bajaj Group is a two-wheeler and three-wheeler manufacturing company that exports to 79 countries across several countries in Latin America, Southeast Asia, and many more.

You would have gotten back 40% of your initial investment in the form of dividends if you had purchased this auto stock during the year 2013. It has acquired 48 percent of the KTM Brand which manufactures sports and super sports two-wheelers, which was 14 percent in 2007 when the company first acquired KTM.

It is the world’s fourth-largest manufacturer of motorcycles and the largest manufacturer of 3-wheelers globally.

In FY20, it signed an MoU with the Maharastra Government to set up a plant in Chakan to manufacture high-end KTM, Husqvarna, Triumph, and Chetak (Electric Scooter). We love companies that invest in R&D and it’s worth mentioning that this company spent 1.6 percent of its revenue on R&D in FY20, which stood at 1.4 percent in FY14.

Its R&D department also upgraded 23 motorcycle variants and 12 commercial vehicle variants to BS-VI during the last two quarters of the pandemic year 2020. We have covered some more elements about Bajaj Auto in our exclusive write-up on the Top 10 Indian Auto companies.

10. ITC Ltd

Seems to be always testing the patience of young and restless investors, This sleeping giant was established in 1910.

ITC Ltd. is the largest cigarette manufacturer and seller in the country. ITC operates in five business segments at present — FMCG Cigarettes, FMCG Others, Hotels, Paperboards, Paper and Packaging, and Agro Business.

This sluggish stock often referred to as a fixed deposit of the stock market would have returned 34 percent of your capital to you in the form of dividends, had you invested in the year 2013.

Averaging this stock at ₹206 – ₹210 levels have returned max returns to us during the past decade. Feel free to learn more about fair prices in our Stock Valuation Pro Module®

ITC is the leader in the organized domestic cigarette market with a market share of over 80 percent. Its wide range of brands includes Insignia, India Kings, Classic, Gold Flake, American Club, etc.

Despite the tobacco vertical contributing only 45 percent to the revenues, it is the most profitable business of the company with 84 percent contribution towards its profit before interest and tax (PBIT).

ITC has 25 mother brands spread across multiple FMCG sectors. Popular brands include packaged foods (Aashirvaad, Sunfeast, Bingo, Yippee noodles, Candyman, and Mint-o); Personal Care (Savlon, Fiama, Vivel, and Superia); Stationary (Classmate and Papercraft); Apparel: Wills Lifestyle; Agarbattis (Mangaldeep and AIM matches).

Many of its brands are leading players in their markets. Presently, Aashirvad Atta, Bingo, Sunfeast & Classmate are the number one players in their markets. Yippee, Engage & Mangaldeep are the number 2 players in their respective industries.

This constitutes about 28 percent revenue of the company. Other revenue streams include Hotels (4%), Agri-Business (13%), and paperboard (10%).

Conclusion

Any long-term portfolio must have a decent number of dividend equities. Although dividend stocks don’t have much growth potential, they can nevertheless yield decent returns through long-term capital growth. Investors who invest in dividend companies can profit from both value growth and reliable, steady income. In the past, it has been found that the dividend technique performs well in tense and uncertain situations.

Many high-dividend companies have the potential to produce positive returns during periods of rising inflation because, unlike fixed bond payments, dividends can keep pace with inflation.

The study and companies discussed in this article are meant to be informative. It shouldn’t be used as advice for making investments.

We’d love to know what you think about dividends in the comments below.

🔔 Investing costs money but sharing your opinion on this blog is free!

Click to read more Top-10 lists.

2 Comments

Wow, very humble and simple explanations. Even though I’m still a novice, I think this article is jam-packed with useful information 🙏

We are glad you like it, Amit; thanks.