Dive into the world of diamond investment by understanding the 4Cs: Cut, Clarity, Color, and Carat weight. Learn how these factors influence a diamond’s quality and value, and discover the importance of evaluating them holistically. Explore additional factors like fluorescence, shape, certification, and provenance to make well-rounded investment decisions in the diamond market.

In this Article

ToggleThe Context

Investing in diamonds offers a unique opportunity for investors to diversify their portfolios with a tangible and potentially valuable asset.

However, the intricacies of the diamond market can be overwhelming for common people, particularly when it comes to understanding a diamond’s quality and value. That’s where the 4Cs of diamond grading come into play. Cut, clarity, color, and carat weight are the key factors used to assess and determine the quality of a diamond.

In this article, we will demystify the 4Cs and explain their significance for retail investors looking to make rational decisions in the diamond market.

Cut: The Brilliance Factor

The cut of a diamond refers to its proportions, symmetry, and overall craftsmanship, all of which affect its ability to reflect and refract light. A well-cut diamond maximizes its brilliance, fire, and scintillation, making it visually stunning. Diamond cut grades range from Excellent to Poor, with each grade depicting a specific level of light performance. For most investors, a well-cut diamond holds higher value and desirability in the market.

A diamond’s cut is crucial because even a stone with exceptional clarity and color will appear lackluster if its cut is subpar. Additionally, a well-cut diamond can potentially command a premium price due to its exceptional beauty.

When investing in diamonds, it is important to prioritize a superior cut to maximize the stone’s value.

Clarity: The Purity Assessment

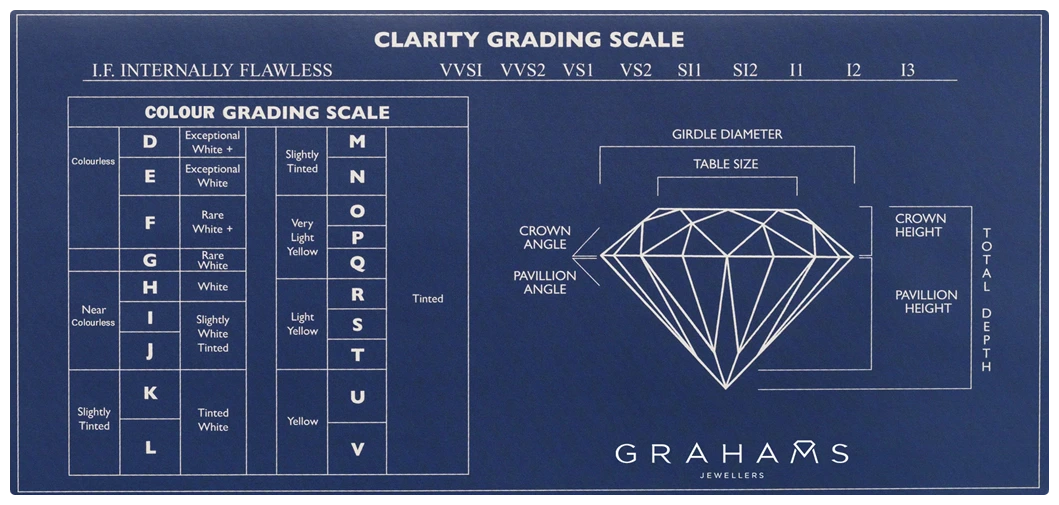

Clarity refers to the presence or absence of internal and external flaws, known as inclusions and blemishes, within a diamond. Gemological laboratories use a clarity scale to grade diamonds, ranging from Flawless (no inclusions or blemishes visible under 10x magnification) to Included (inclusions visible to the naked eye). The clarity grade affects a diamond’s rarity and, consequently, its value.

You should consider a diamond’s clarity grade about your budget and personal preferences. While higher clarity grades signify greater rarity and higher prices, diamonds with slightly lower clarity grades can still possess exceptional beauty.

Balancing clarity and budget considerations is important to make informed investment decisions and maximize returns.

Color: The Hue Evaluation

The color of a diamond refers to its degree of whiteness or presence of color. The Gemological Institute of America (GIA) uses a color scale that ranges from D (colorless) to Z (light yellow or brown) to grade diamonds.

The most valuable diamonds typically exhibit little to no color, while lower-grade diamonds display more noticeable color.

Color grades significantly impact a diamond’s beauty, rarity, and value. You should consider factors such as your personal preferences, diamond settings, and market demand when evaluating a diamond’s color. It is important to strike a balance between color and other factors to optimize investment potential.

Carat Weight: The Size Factor

Carat weight is the standard unit of measurement for a diamond’s size. One carat is equal to 200 milligrams. While carat weight provides a general indication of a diamond’s size, it does not determine its quality or beauty. Two diamonds with the same carat weight can differ significantly in terms of cut, clarity, and color.

You should understand that carat weight alone does not guarantee a diamond’s value. Other factors, such as the quality of the diamond’s cut and the presence of inclusions or color, play a crucial role in determining its overall worth. When considering carat weight, it is essential to evaluate the stone holistically and consider the interplay between the 4Cs.

Evaluating the 4Cs Holistically

While the 4Cs provide a framework for diamond evaluation, it is important to understand that these factors do not exist in isolation. A holistic approach to diamond grading involves considering the interplay between the 4Cs and how they contribute to a diamond’s overall quality and value.

For example, a diamond with a higher color grade may compensate for a lower clarity grade, as the color can mask the presence of certain inclusions. Similarly, a well-cut diamond can enhance the appearance and perceived color of a stone, making it more visually appealing.

You should aim to strike a balance between the 4Cs based on your investment goals and personal preferences. It may be beneficial to prioritize certain factors over others. For instance, if the goal is to maximize brilliance and visual appeal, a higher cut grade might be prioritized over other factors. On the other hand, if rarity and value preservation are paramount, a higher color or clarity grade might take precedence.

Understanding the interplay of the 4Cs allows you to make better decisions and evaluate diamonds beyond individual grades. It enables a comprehensive assessment of a diamond’s overall quality and investment potential.

Beyond the 4Cs

While the 4Cs form the foundation of diamond grading, there are additional factors that you should consider when assessing the value and investment potential of a diamond.

Fluorescence

Some diamonds exhibit fluorescence, which is the emission of visible light when exposed to ultraviolet (UV) light. While fluorescence is not part of the 4Cs, it can impact a diamond’s appearance. Strong fluorescence can cause a diamond to appear milky or hazy, potentially affecting its value. However, fluorescence can also enhance a diamond’s color in certain cases, making it more desirable.

Shape

The shape of a diamond, such as round, princess, emerald, or pear, influences its market demand and pricing. Round diamonds are the most popular and often command higher prices, while fancy-shaped diamonds can offer unique appeal and potential investment opportunities.

Certification

Reputable gemological laboratories, such as the GIA, provide grading reports that certify a diamond’s quality and authenticity. Investing in certified diamonds offers peace of mind and ensures an accurate representation of the stone’s characteristics.

Provenance

The origin and history of a diamond can add value and intrigue, particularly for rare and exceptional stones. Diamonds with documented origins, such as those from famous mines or historical periods, can be highly sought after by collectors and investors.

Considering these supplementary factors alongside the 4Cs allows retail investors to make more comprehensive assessments of diamonds and potentially uncover investment opportunities.

Conclusion

Understanding the 4Cs of diamond grading is essential for investors venturing into the diamond market. Cut, clarity, color, and carat weight form the foundation for evaluating a diamond’s quality and value. However, it is important to assess these factors holistically, considering their interplay and prioritizing them based on investment goals and personal preferences.

Beyond the 4Cs, you should also consider factors such as fluorescence, shape, certification, and provenance to make more informed investment decisions. By thoroughly evaluating diamonds using a comprehensive approach, you can maximize your chances of acquiring diamonds with long-term value appreciation potential.

Navigating the world of diamond investing requires knowledge, research, and engagement with reputable experts in the field. Armed with a thorough understanding of the 4Cs and a holistic approach to diamond evaluation, you can confidently embark on your diamond investment journey. Remember, diamonds are not only exquisite gems but also potential storehouses of value and unique additions to a diversified investment portfolio.

We hope you found this article informative and enjoyable to read.

Invest wisely!