Cryptocurrency might sound complex, but it’s basically a digital or virtual type of money that uses special math and codes to make sure it’s safe and real. It’s like money you can’t touch, but it’s still worth something! If you’re planning to gather an understanding of cryptocurrencies, it’s essential to know which ones are the most popular.

In this article, we’ll introduce you to the top 10 cryptocurrencies you should be aware of.

In this Article

ToggleThe Context

Cryptocurrency is a digital or virtual currency that uses cryptography to secure and verify transactions and to control the creation of new units. Unlike traditional currencies, which are issued by governments or financial institutions, cryptocurrencies operate independently of a central authority.

They are decentralized, meaning that they are not subject to government or financial institution control, and they are typically based on blockchain technology, which is a public ledger of all transactions that cannot be altered or deleted. Cryptocurrencies are commonly utilized as a digital mode of payment for goods and services and based on their liquidity, they can also be exchanged for other currencies or assets on cryptocurrency platforms.

Cryptomania, a significant generational phenomenon of the 2000s, has attracted numerous investors due to the potential for success in the future. Investing in cryptocurrency is risky due to the high volatility of its value, vulnerability to hacking and cyber attacks, lack of government or financial institution backing, and susceptibility to fraud and market manipulation. As a result, investors should exercise caution and carefully consider the potential risks and rewards before investing.

Here’s our list of the top most popular cryptocurrencies that all potential investors should be aware of.

1. Bitcoin (BTC)

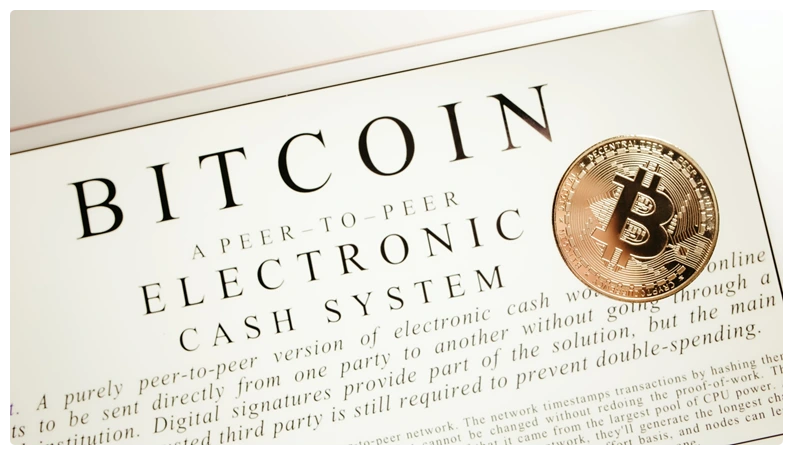

Bitcoin is the most popular decentralized digital currency that was created in 2009 by an anonymous individual or group using the pseudonym “Satoshi Nakamoto“. Its origins lie in a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” which proposed a new type of currency that could be sent directly from one party to another without the need for a financial intermediary.

Bitcoin transactions are verified by a decentralized network of computers using cryptography and recorded on a public ledger called the blockchain. The total supply of Bitcoin is limited to 21 million coins, with new coins created through a process called mining. Bitcoin is often referred to as the first and most well-known cryptocurrency and has since inspired the creation of numerous other digital currencies.

2. Ethereum (ETH)

Ethereum is another popular decentralized, open-source blockchain platform that was launched in 2015 by a developer named Vitalik Buterin.

Its native cryptocurrency is called Ether (ETH) and it is the second-largest cryptocurrency by market capitalization after Bitcoin. Ethereum allows developers to build decentralized applications (dApps) on top of its blockchain using smart contracts, which are self-executing contracts with the terms of the agreement written directly into code.

These apps can be used for a wide range of purposes, including decentralized finance (DeFi), gaming, social media, and more. Ethereum is also undergoing a major upgrade to a new version called Ethereum 2.0, which aims to improve the platform’s scalability and security while also reducing its environmental impact.

3. Binance Coin (BNB)

Binance Coin (BNB) was created by the cryptocurrency exchange Binance in 2017. It is used primarily to pay for trading fees on the Binance exchange, but it can also be used to pay for other services offered by Binance, such as listing fees for new cryptocurrencies.

Binance Coin operates on the Ethereum blockchain and uses the ERC-20 token standard. Its total supply is limited to 200 million coins, with Binance planning to buy back and burn a portion of the coins each quarter to reduce its overall supply over time. In addition to its use on the Binance exchange, Binance Coin is also accepted by a growing number of merchants and can be traded on other cryptocurrency exchanges.

4. Cardano (ADA)

Cardano (ADA) was launched in 2017 by IOHK, a blockchain research and development company. Cardano is designed to be a more energy-efficient and secure alternative to older blockchain platforms like Bitcoin and Ethereum. Its blockchain uses a proof-of-stake consensus algorithm, which allows users to “stake” their ADA coins to help verify transactions and earn rewards.

Cardano’s development is guided by a group of academic researchers and engineers, who focus on building a scientifically rigorous and peer-reviewed platform. The platform is also designed to support the development of decentralized applications (dApps) and smart contracts and has a growing ecosystem of developers and projects built on top of it. The last we checked, Cardano turned out to be one of the third largest cryptocurrencies by market capitalization and has gained a significant following among investors and developers.

5. Dogecoin (DOGE)

Dogecoin (DOGE) was created in 2013 by software engineers Billy Markus and Jackson Palmer. It is based on the popular “Doge” internet meme featuring a Shiba Inu dog. Initially created as a parody of Bitcoin, Dogecoin has since become a popular cryptocurrency in its own right with a strong and enthusiastic community of supporters.

Dogecoin operates on a proof-of-work consensus algorithm similar to Bitcoin but with faster block times and a higher maximum supply of coins. Dogecoin has gained attention in the mainstream media due to endorsements by high-profile figures such as Tesla CEO Elon Musk and has experienced significant price volatility as a result. Despite its playful origins, Dogecoin has also been used for charitable causes and fundraising efforts.

6. XRP (XRP)

XRP is used for cross-border payments and remittances. It was created by Ripple Labs in 2012 and is based on a decentralized, open-source blockchain technology called XRP Ledger. XRP is designed to be a fast and cost-effective way to transfer money across borders, with transactions settling in just a few seconds and at a fraction of the cost of traditional methods. Unlike other cryptocurrencies, XRP is not mined, but rather pre-mined and issued by Ripple Labs in 2012 and is based on a decentralized, open-source blockchain technology called XRP Ledger.

XRP is designed to be a fast and cost-effective way to transfer money across borders, with transactions settling in just a few seconds and at a fraction of the cost of traditional methods. Unlike other cryptocurrencies, XRP is not mined, but rather pre-mined and issued by Ripple Labs in a limited supply of 100 billion coins. XRP is used by financial institutions and payment processors to facilitate cross-border transactions, and Ripple Labs has partnerships with numerous banks and financial institutions around the world.

However, XRP has also faced legal challenges and regulatory scrutiny over its status as a security, and its value has been subject to volatility as a result.

7. Polkadot (DOT)

Polkadot (DOT) is a decentralized blockchain platform that aims to provide interoperability between different blockchains. It was created by Ethereum co-founder Gavin Wood and launched in 2020.

Polkadot allows for different blockchains to connect and communicate with each other, creating a “multi-chain” ecosystem where different applications can interact and share data. This interoperability is facilitated by the use of “parachains,” which are custom-built blockchains that can be connected to the Polkadot network. DOT is the native cryptocurrency of the Polkadot network and is used for governance and staking, allowing users to participate in the network and earn rewards.

Polkadot’s unique architecture and focus on interoperability have made it popular among developers and projects building decentralized applications (dApps) and other blockchain-based projects.

8. Solana (SOL)

Solana (SOL) is a decentralized blockchain platform designed for high-speed transactions and scalable decentralized applications (dApps). It was launched in 2020 by the Solana Foundation and features a unique architecture that allows for extremely fast transaction processing speeds of up to 65,000 transactions per second.

Solana achieves this speed through a combination of a high-performance consensus algorithm called Proof of History (PoH) and a network of parallel processing nodes. SOL is the native cryptocurrency of the Solana network and is used for staking, transaction fees, and governance.

Solana has gained popularity among developers and projects building decentralized finance (DeFi) and other blockchain-based applications due to its speed and low transaction fees. It has also been the subject of partnerships and collaborations with various companies and organizations in the blockchain and technology industries.

9. USD Coin (USDC)

USD Coin (USDC) is a stablecoin cryptocurrency that is pegged to the value of the US dollar. It was launched in 2018 by Circle and Coinbase and is an ERC-20 token on the Ethereum blockchain. The value of USDC is backed by a reserve of US dollars held by regulated financial institutions, with the supply of USDC tokens being regularly audited to ensure full reserve backing.

USDC is designed to provide the stability of the US dollar while also offering the benefits of blockchain technology, such as fast and low-cost transactions. USDC can be used for a wide range of purposes, including trading on cryptocurrency exchanges, making payments, and transferring funds across borders. The use of stablecoins like USDC has become increasingly popular in the cryptocurrency industry as a way to mitigate the volatility of other cryptocurrencies like Bitcoin and Ethereum.

10. Uniswap (UNI)

Uniswap (UNI) is a decentralized cryptocurrency exchange (DEX) that operates on the Ethereum blockchain. It was launched in 2018 by Hayden Adams and is designed to facilitate the exchange of Ethereum-based tokens without the need for intermediaries or centralized exchange platforms.

Uniswap uses an automated market maker (AMM) system, which allows users to trade cryptocurrencies by using liquidity pools instead of traditional order books.

UNI is the native cryptocurrency of the Uniswap platform and is used for governance and staking. Users can earn rewards by providing liquidity to Uniswap’s liquidity pools, which are used to facilitate trades on the platform.

Uniswap has become one of the most popular decentralized exchanges in the cryptocurrency industry and has been used for a wide range of trading activities, including swapping tokens, providing liquidity, and earning rewards.

Conclusion

Cryptocurrencies can provide high returns but are volatile and subject to significant price swings. Due to the largely unregulated market, cryptocurrencies are susceptible to fraud, scams, and manipulation. Therefore, investing in cryptocurrency should be approached with caution and requires careful consideration of potential risks and rewards.

Our recommendation to investors considering investing in cryptocurrency would be to limit their exposure to this instrument to an amount they are comfortable losing without regret, given the lessons learned from the history of this market.

Conducting research and seeking advice from financial professionals is crucial before making any investment decisions. Ultimately, the decision to invest in cryptocurrency should be based on personal circumstances and risk tolerance.

We are devoted to supporting you in achieving financial success. To help you improve your financial literacy and accomplish your financial objectives, you’ll find a wealth of useful information, interactive courses, and other resources right here.

🔔 Investing is expensive, but leaving comments on this blog is free!