In this blog article, we’ll be taking a closer look at the life and investment strategies of one of the most influential figures in the financial world, Carl Icahn. Join us on a journey through his remarkable career, as we uncover the secrets to his success and the valuable lessons he has to offer to aspiring investors.

In this Article

ToggleThe Context

Welcome to another episode of “Exclusives.” Before we get into the exciting journey of Carl Icahn, let’s talk about why it’s important to learn from successful investors.

For people who like to do their own investing, understanding the lives, strategies, and thoughts of accomplished investors is like learning from master craftsmen. It gives you valuable lessons, sparks new ideas, and gives you the knowledge you need to navigate the unpredictable world of financial markets. Carl Icahn, a famous investor, has a wealth of wisdom to share with anyone aiming to succeed in investing.

Get ready for an exciting journey as we explore his life story and take a closer look at his investment strategies and approach.

Understanding the Intellect of Carl Icahn

Carl Celian Icahn was born on February 16, 1936, in Queens, New York City. He came from a regular, middle-class family. He chose an unconventional path in education, studying philosophy at Princeton University and graduating in 1957. This unusual choice laid the foundation for his distinctive approach to investing.

His journey into investing started when he dabbled with small investments in stocks while at Princeton. But it was during medical school that he experienced his first major investment success, which fueled his passion for the financial markets. He wasn’t just about making money; he also helped his fellow medical students financially, showing his caring side. Eventually, he made a life-changing decision to leave medical school and pursue a career in finance.

What sets Icahn apart is his belief in sharing knowledge. He took classes at Princeton and wrote influential papers like “Investment Performance of Mutual Funds in the Period 1945-1964,” establishing his reputation as a financial thinker. His writing extended beyond academia; his books, such as “Icahn: An Autobiography” and “You Can’t Make This Stuff Up: Life-Changing Lessons from Heaven,” provide readers with a unique glimpse into his investing philosophy and personal journey. These books gained popularity because they offer candid insights into the mind of a billionaire investor.

Solving Icahn’s Puzzle

Carl Icahn’s approach to investing can be described as activist. Carl Icahn’s activist approach to investing is shared by other notable figures in the investment world like Bill Ackman and George Soros. These investment icons also believe in taking significant positions in companies and actively working to influence their direction to create value for shareholders.

During his prime, he believed in making big investments in companies and then actively working to make an impact that would make the company more valuable for its shareholders. He had a talent for finding companies that were worth more than their stock prices suggested and using his influence to make them more profitable, which is legendary in the investment world.

One of his most famous investments was in RJR Nabisco, where he took an assertive approach that resulted in substantial gains for the company’s shareholders. His “Icahn Lift” concept, where a stock’s price goes up simply because he’s involved, demonstrates the effectiveness and influence of his strategy.

Icahn has a unique ability to navigate the complex world of corporate business, which earned him billions in profits. His high-profile battles with major corporations like Apple and eBay, where he pushed for changes in how they operated, show his unwavering dedication to the interests of the shareholders.

Let’s Talk Stocks: The Fab Five

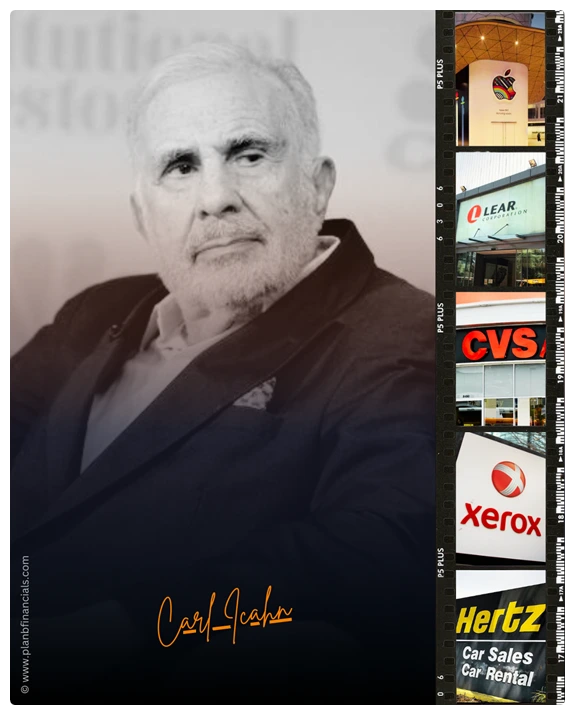

1. Apple Inc. (AAPL)

Icahn recognized the potential of Apple’s stock and pushed for increased stock buybacks, contributing to its rise as a tech behemoth.

2. CVS Health Corporation (CVS)

Icahn’s investment in CVS highlighted his strategic bets in the healthcare sector.

3. Lear Corporation (LEA)

His stake in Lear Corporation showcased his penchant for identifying undervalued manufacturing companies.

4. Xerox Corporation (XRX)

Icahn’s involvement in Xerox aimed to unlock shareholder value through strategic changes.

5. Hertz Global Holdings, Inc. (HTZ)

His decision to invest in Hertz showcased his readiness to embrace risks and revive companies facing difficulties. For newcomers to the investment world, this serves as an excellent example of deep-value investing.

Pearls of Icahn’s Wisdom

Here are some insights shared by Carl Icahn during his investing career that shed light on the core of his investment philosophy.

💬 “In life and business, there are two cardinal sins: The first is to act precipitously without thought, and the second is to not act at all.”

💬 “The most important thing is to define the question.”

💬 “You learn in this business: If you want a friend, get a dog.”

Carl Icahn’s Influence Continues

Carl Icahn’s incredible journey, starting from a simple background and becoming one of the most influential investors of our time, shows how important knowledge, determination, and a unique investment approach can be. His life story is a big inspiration for people who like to manage their own investments, teaching them important lessons about getting involved, taking risks, and being aware of shareholder rights.

By learning from Icahn’s investment methods, reading his writings, and remembering his wise sayings, investors can better prepare themselves to deal with the complex world of financial markets. To wrap it up, in the ever-changing world of finance, Carl Icahn’s legacy remains a strong source of guidance and motivation for those who aim high and invest wisely.