Creating a dependable income stream that offers stability and security is a financial goal many aspire to achieve. One effective strategy for attaining this objective is constructing a bond ladder. In this article, we’ll take a deep dive into the world of bond ladders, uncovering their nuances and providing insights on incorporating this strategy into your investment portfolio.

In this Article

ToggleThe Context

Bonds are beloved by most experienced investors. It is merely due to the predictability of bond income. Bonds are investment securities where an investor lends money to a company or a government for a set period, in exchange for regular interest payments.

They fluctuate less than equities. Bonds are hence considered a great hedge against market volatility. Bonds are offered by private corporations as well as the government.

☑ Corporations sell bonds to finance ongoing operations, new projects, or acquisitions.

☑ Governments sell bonds for funding purposes, and also to supplement revenue from taxes.

When you invest in a bond, you are a debt holder for the entity that is issuing the bond. A well-rounded investing portfolio should include a variety of bonds, especially investment-grade bonds, as they are generally lower risk than equities. Bonds can also provide a constant stream of income during your retirement years while protecting your cash, helping to mitigate the risk of riskier assets like equities.

The Significance Of Bonds

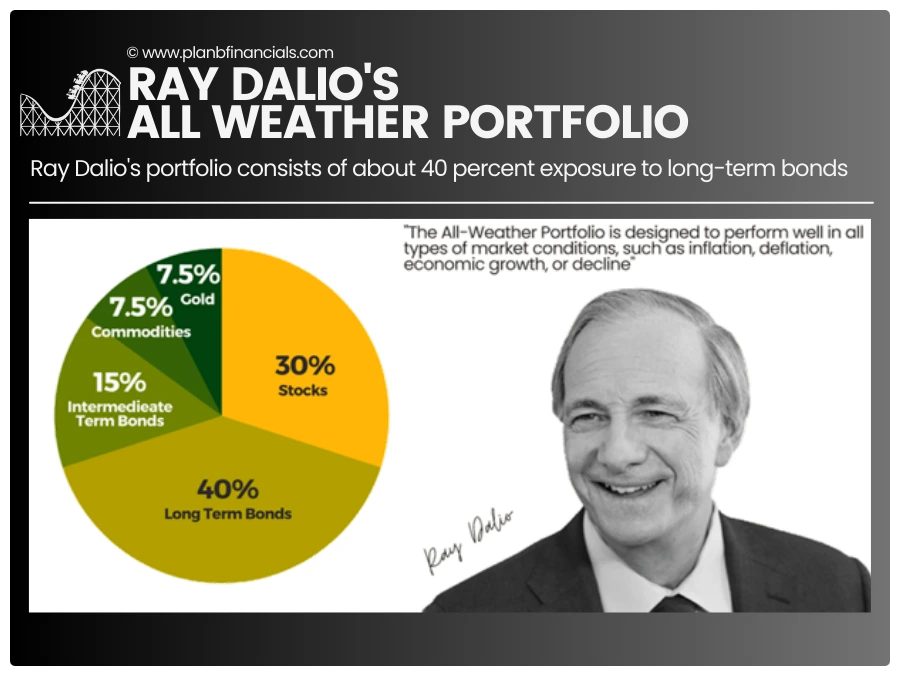

Raymond Thomas Dalio aka Ray Dalio; a successful American billionaire investor, hedge fund manager, and chief investment officer of the world’s largest hedge fund, Bridgewater Associates had been bullish on Bonds throughout most of his career journey.

His once-proposed “All-Weather Portfolio” consists of about 40 percent exposure to long-term bonds. This portfolio is designed to perform well in all types of market conditions, such as inflation, deflation, economic growth, or decline.

This portfolio was back-tested by Tony Robbins and the results were published in his bestseller during the year 2016.

Money Master the Game- 7 Simple Steps to Financial Freedom (Tap to order)

💬 You would have made money 86 percent of the time

💬 The average loss was just 1.9 percent

💬 The worst loss was minus 3.9 percent

💬 The portfolio’s volatility was approximately 7.6 percent

Bond exposure gives a further layer of stability to any balanced portfolio, making them a profitable choice for investors because equities investing has particular drawbacks. However, nothing in the world of investing is thought to be completely risk-free, and bonds are not immune to investment risks.

In our respite, if there are risks there are always some smart strategies to minimize the potential harms. One such tactic that many cautious investors use to pursue the best and safest bond returns is gradually increasing bond exposure through a bond ladder.

What Is A Bond Ladder?

The most fundamental risk that bonds are subject to is an interest rate risk. Unusual and erratic changes in interest rates are caused by uncertainty and economic developments.

A bond ladder is a strategy used to manage interest rate risk. In this strategy, you simply buy bonds of varying maturity dates. Staggering maturities help avoid getting locked into a single interest rate.

A ladder also helps steady out the impact of fluctuations in interest rates because there are bonds maturing every year, quarter, or month, depending on the number of steps on the ladder. Following a cyclical process, when a bond matures, you can reinvest that principal in a new longer-term bond at the end of a ladder.

If interest rates have risen, you’ll benefit from a new, higher interest rate and keep the ladder going.

On the other hand, if interest rates dropped, it would be unpleasant since aging bonds would probably be reinvested at lower rates, while bonds at the top of the ladder would probably already have secured greater yields.

Getting Started With A Bond Ladder?

A minimal understanding of computing is needed to create a bond ladder and this is a very simple process.

The overall length of time, the gaps between different maturities, and the types of securities that are to be purchased are three key considerations while building one. Your invested money is routinely split up and placed in several investments so that you receive interest payments virtually every month.

If a bond is giving out interest payouts every 6 months, then the principal amount is invested in 6 parts. For instance, if you decide to invest ₹1 lakh in a short-duration bond that yields a 2.5% interest payout every 6 months, you would simply invest 1/6th of the money in tranches or in a staggered way.

In other words, ₹16,666 per investment lot.

This means for an investment committed in January, you will receive your first payout of ~ ₹416 (₹16,666 @ 2.5% yield); in July (at the end period of 6 months). In the same way, if you make another investment in February, you will receive the same amount in August, then in September, then in October, and so on.

Here’s another example of the same ₹1 lakh invested over a spread of 12 months (12 equated lots)–

You continue to earn monthly amounts throughout the year as long as you keep reinvesting the bond’s principle while keeping your income.

It is up to you whether to keep the interest money or reinvest it to continue compounding.

Bonds with longer maturities tend to offer higher yields, though reducing the bond maturities generally curtails income and interest rate risk. You can also diversify within clearly defined bond categories, such as the ones listed below, to increase the stability of your ladder.

☑ Government Treasury Bills (T-Bills)

☑ Corporate Bonds

☑ Zero-Coupon Bonds

☑ Inflation-Linked Bonds

☑ RBI Bonds

☑ Sovereign Gold Bonds

☑ Convertible Bonds

Acquiring the components of a bond ladder

Many investors think of the term “fixed income” as synonymous with bonds but that’s not true. Just like the securities market, bonds are traded in the bond markets, which is different from the money markets. In reality, a bond is just a subset of a fixed-income security.

The money market is fundamentally different from the bond market in that it focuses on relatively short-term debt products. These are the debts with maturities of under a year.

Bonds are undoubtedly tricky investments!

The following instruments can be purchased to create the foundation for your bond ladder:

≡ Corporate Bonds

Most corporate bonds can be purchased through your stockbroker. The second choice is to use mutual funds or exchange-traded funds (ETFs) in a passive manner. For investing directly in individual corporate bonds, you should have top-to-bottom knowledge of the fundamentals of the issuing company.

≡ Government Bonds

You can directly participate in bids to purchase government bonds. You can register with the exchange and place your purchase there, but once the bonds have been issued, you will need a Demat account to keep or trade them.

You can alternatively buy Government Bonds through your stockbroker as well. For this, you need to participate through non-competitive bidding. But in this case, the yield gets decided based on the bids of all the institutional investors, and you get the Bond allocation based on the market yield.

The minimal risk associated with investing in government bonds is its largest benefit. There is no risk of default, but still, the interest rate might fluctuate. The longer the Bond term, the more sensitive it is to interest rate volatility.

Before choosing to purchase government bonds, take into account the interest rates and duration. Additionally, make sure that the money invested in the Bond generates a sufficient return over time.

Conclusion

Locking in 40 percent of your capital in long-term Bonds as illustrated in Ray’s “All Weather Portfolio” may not be the best strategy during a post-covid; low-interest layout, but bonds actually are safer than equities.

They shouldn’t be compared to equities in terms of returns, but they do contribute to balancing the risk that all stocks and shares are exposed to. Bond investments make a compelling case in bear markets because they are viewed as safe havens in volatile market conditions.

As the stock market declines, bond yields increase, and taking advantage of these opportunities is a fantastic way to create your own bond ladder.

Note- The information provided above is only to be used for educational purposes. Please consult a registered (fee-only) financial advisor for more details.

Your experiences with bonds and similar financial instruments are very welcome.

🔔 Investing is expensive, but leaving comments on this blog is free!

2 Comments

I enjoy reading your posts. Love the way you simplify complexities.

Boss, I really find bonds confusing. You guys have explained it well. Looking forward for some more articles on Bond type instruments.